Utilities evaluating build-outs of foundational communications networks like private long-term evolution (PLTE) are about to make generational decisions. A PLTE network can serve as a platform to drive the business for the foreseeable future. This is why each component must be examined with appropriate rigor to clearly outline and forecast the benefits that will be realized over its lifetime of service.

Moreover, once a decision is made to investigate PLTE, the focus should immediately shift to spectrum and the proper technology to achieve desired outcomes.

Several recent Federal Communication Commission (FCC) rulings have provided a clear path for utilities to solve grid challenges with wireless broadband solutions. The three most impactful rulings thus far are the 900 MHz (3x3 MHz Channel) rebanding order in May 2020, the 3.5 GHz (10 MHz Channel) Citizens Broadband Radio Service (CBRS) auction that concluded in August 2020, and the reallocation of the 4.9 GHz band in September 2020.

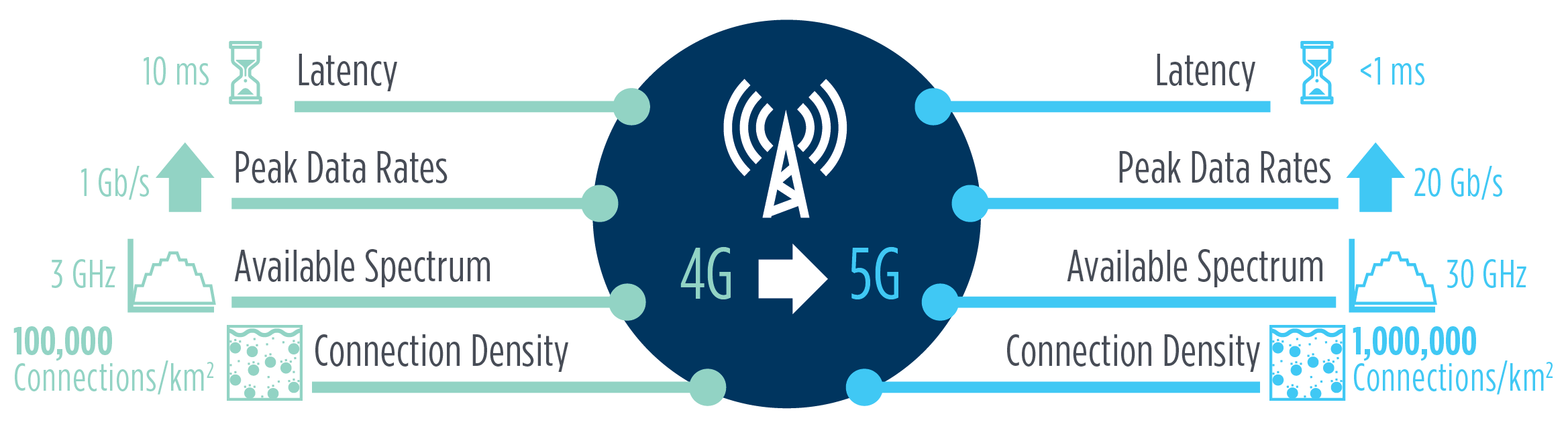

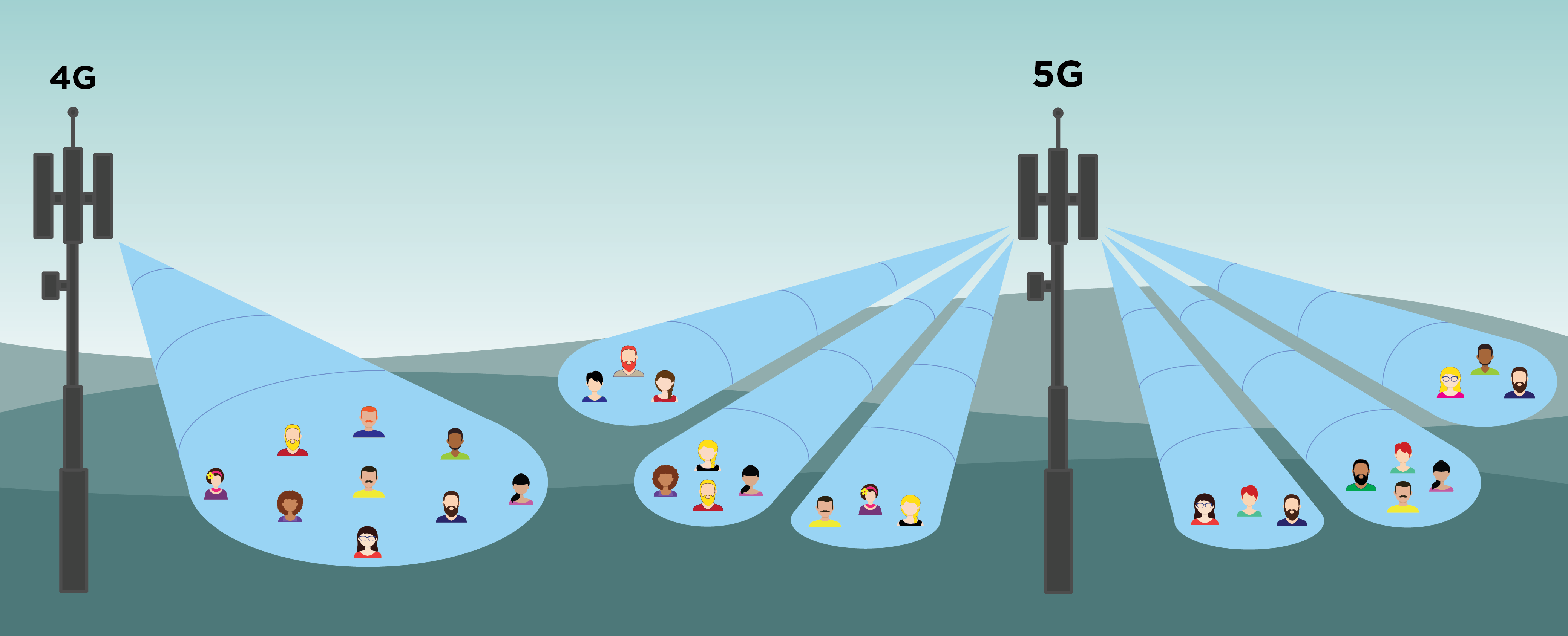

Each spectrum offering has its own specific pros and cons and use cases. But now the focus has shifted from spectrum to technology and an interesting debate over the relative merits of 4G versus 5G.