The U.K. is showing unquestioned leadership in striving to become the world’s first major economy to achieve net-zero carbon emissions.

Moving from the previous 80% target to 100% reduction from 1990 carbon levels by 2050 will require major investments in all aspects of energy infrastructure, as well as revision of current energy regulatory regimes. Though the difference between 80% and 100% may seem insignificant, it is not. Achieving this goal will require a wide range of innovative engineering solutions.

The U.K.’s Road to Zero Strategy and Industrial Strategy are guided by the principle that market forces must be harnessed to meet carbon reduction goals. The 42% reduction in carbon emissions achieved to date is strong evidence this was correct. Utilities are becoming energy platforms that enable competition, and consumers now have unprecedented choices among energy suppliers. Ultimately, network owners will perhaps simply become the backbone for an “energy internet,” providing a platform for service providers to bolt on end-customer solutions and solve traditional problems with innovative approaches.

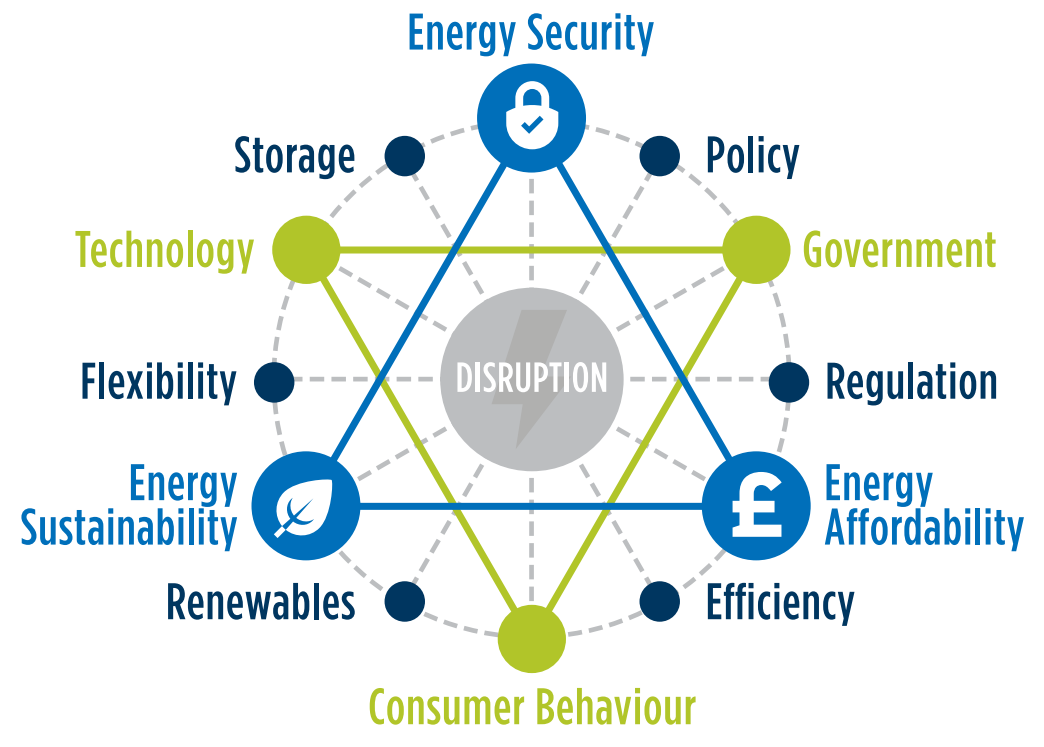

But utilities are likely to face even more uncertainty in the future as consumer demands continue to evolve, the RIIO-2 plan is implemented, and technology innovation accelerates. These forces will exert more pressure on utilities as the U.K. challenges itself to meet zero-carbon goals.