Every economic development stakeholder — including site selectors, developers, energy companies, utilities and end-users — is impacted by this energy conundrum. Each also plays a role in its solution.

End-Users

Set clear, realistic goals when creating a request for information (RFI). Some site selection challenges can be preempted by those writing the specifications for new projects. Authors should know that providing 700 MW would require a solar installation that is more than four times the size of New York City’s Central Park. A spec calling for 100% green energy, 24/7, upon a new development’s commissioning is therefore challenging. All stakeholders benefit when an RFI establishing power requirements that reflect an understanding of not only a project’s energy needs, but also the availability of generation sources.

More nuanced specifications are possible when facilities are pre-engineered prior to site selection. By scaling up operation in stages, for example, operators might determine that a project won’t require full power capacity until its seventh year of operation. By identifying actual energy needs for years one, three and five, engineers can design a phased approach to ramping up capacity over time. Specifications can then align more closely with the availability of power alternatives. RFIs can also describe the end-users’ priorities for renewables, indicating which power sources do and do not suit their ESG goals.

Consider alternative sources of on- and off-site power. End-users can help their own causes by sourcing a portion of their own power. The alternatives will depend on multiple factors, from land availability and ESG goals to their time-of-day power needs:

- Wind/solar — Some companies might consider collocating a source of renewable power at or near the project site. Given that it takes approximately 7 acres to generate a single megawatt of solar power, however, few sites are large enough to house a renewable project large enough to serve a substantial load. These projects are often used to supplement other power sources during peak demand periods.

- Virtual power purchase agreement — Rather than produce power on-site, organizations with aggressive ESG goals might opt to purchase renewable power through a virtual power purchase agreement. Unlike a traditional PPA, which involves purchasing renewable energy from a local developer, a virtual PPA eliminates the need for proximity because there is no physical exchange of energy. Instead, companies achieve emission reduction goals by receiving credits for purchasing renewable energy that is generated and used in areas where large-scale wind and solar farms have been constructed more economically.

- Microgrid — End-users can augment their power capacity using a microgrid — a small-scale, on-site power grid that can operate independently or connected to the larger grid. Electricity generated using wind turbines or solar arrays can either be used in real-time or stored in large batteries for later use. A microgrid strategy is often most effective in locations where there is above-average risk of power being unavailable in periods of high demand or due to grid failure. North American Electric Reliability Corp. (NERC) reliability assessments for winter and summer months can be helpful in assessing risks in various geographic locations. So can design and construction planning consultants, who can help optimize options for renewable or backup generation sourcing to minimize business losses. This strategy, however, runs the risk of large curtailments of renewable power until sufficient interconnections can be built.

Utilities and Economic Developers

Work together to identify potential sites for development. The real estate development process has long been led by local economic development teams that assess site availability, choosing a select few to make shovel-ready with roads, water access and other basic infrastructure.

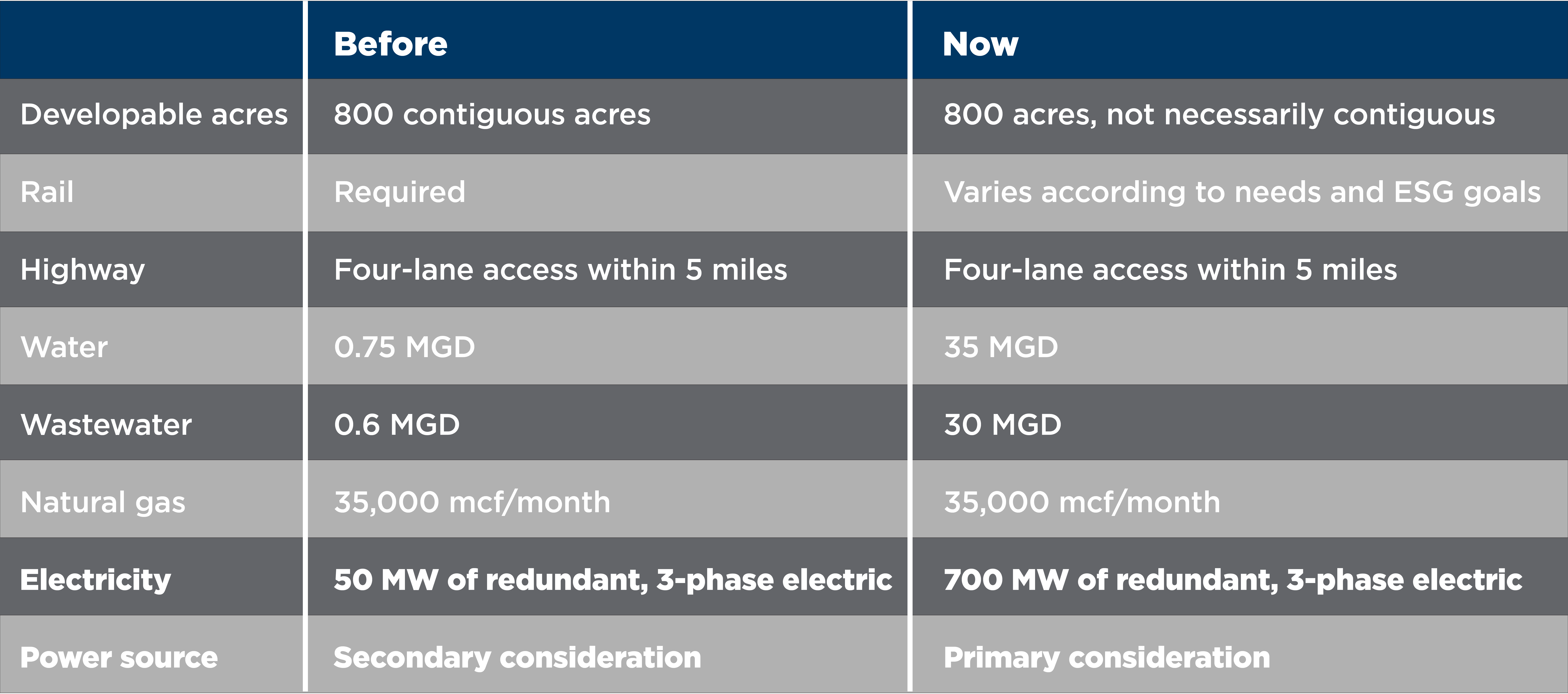

In a market in which power availability is increasingly becoming a primary site selection screening criterion, it is essential for economic developers to partner with the local electric utility before selecting sites. The utility can provide early input on locations that are better equipped with power lines, substations and other assets to take on large-scale load.

Position assets for build-outs that align with corporate ESG goals. No matter the size of a land parcel, its chances of development success depend in part on its ability to serve the ESG goals of future end-users. The assets and deficiencies of individual sites, therefore, should be identified and viewed through the lens of ESG. For example, railroad access that could once be marketed as an asset may be viewed otherwise if the railroad is not also pursuing carbon reduction goals.

Early utility involvement can benefit developments in other ways as well. Utilities that are mindful of federal, state and allied agencies’ funding and sustainability initiatives may be able to recommend sites that could be tapped to accommodate renewables and storage development. Utilities can also help develop master plans that identify utility routing and infrastructure placement options that are mindful of ESG needs.

Identify new risks and ways to mitigate them. Once sites are identified, due diligence and master planning are critical next steps. Through due diligence, developers identify site assets and deficiencies that should help confirm the validity of the industrial targets being pursued. Due diligence and master planning activities also support plans for capital improvements that align budgets with curing critical infrastructure deficiencies, including power capacity and service upgrades.

When planning such capital investments, utilities and economic developers would be wise to identify risks they may expose in the process. Risks arise when economic developers’ renewable goals do not align with those of their customers, or when delays, reliability or cost concerns affect their ability to meet agreed-upon power delivery deadlines. They will need to develop a mitigation strategy for each risk identified to close any gaps. These assessments can also help identify industries that would be well-suited to a site’s capabilities and help in developing a business case for marketing each site.