Having adapted to the changes RIIO-T1 brought to the sector, transmission network operators (TNOs) have become astute in managing risk and uncertainty in a manner that has improved reliability cost-effectively. However, RIIO-T2 poses additional challenges and uncertainty with regard to future business planning and investment returns. Ofgem should recognise this and provide better opportunities and mechanisms to reward companies for outperforming their business plans.

THE IMPACT OF REDUCING COST OF EQUITY

The cyclical nature of the regulatory process continues to create boom and bust periods of investment, which constrains the supply chain’s ability to invest in and maintain specialised resources at a time when the U.K. most needs to grow its resource pool. Ofgem has further challenged the TNOs by cutting the cost of equity to 4 percent, potentially constraining investment into the transmission and distribution sector. Capping returns on investment when arguably more investment is needed is a curious move by Ofgem when one considers that transmission accounts for only 5 percent of a customer’s electricity bill and is arguably the most critical component of electric infrastructure from a reliability perspective.

Ofgem has helped justify its new price control proposal by citing the need to gain more input from consumers and to rein in the perception of high electricity costs. Political leaders have driven much of this stance and will need to deal with the consequences. Stakeholder inputs, by way of the free market and government objectives such as the Road to Zero Strategy and increasing demand for EVs, drive investments in infrastructure. Those investments must account for known and unknown future needs and transform the transmission network into a flexible platform for a wide array of generation and load-bearing assets. TNOs can use this as an opportunity to innovate their own business model. For example, in the United States, the New York Public Service Commission is asking network operators to invest ahead of need to meet stakeholder demands. Recently, the regulator authorised utilities to spend $31.6 million to build more than 1,000 fast-charging EV stations in the region and recover costs from ratepayers over seven years.

OUTPERFORMING INCENTIVES THROUGH NEW DELIVERY MODELS

Numerous industry and market analysts have raised concerns at the potential for investment in the market to shift to other countries at a time when it is most needed. However, Ofgem has noted that TNOs’ actual returns to shareholders can be higher or lower than the baseline allowed return, depending on how well they perform against the incentive mechanisms for delivering better services and/or lower costs. Outperforming incentives, however, essentially requires TNOs to achieve approximately double-digit percent efficiencies while improving services. In order to realise these efficiencies and focus investment in a manner that prepares the transmission network for future needs, TNOs must fundamentally change how they plan, execute and maintain the required transmission infrastructure and transform their own business models.

RETHINKING INVESTMENT

Traditionally, when TNOs have looked to cut costs, they have done so by deferring projects, asking partners to do more with less, and squeezing their supply chains in order to maintain their returns. While this approach has enabled incremental savings, TNOs are unlikely to deliver the required transformational change while managing corporate risk and maintaining quality, safety and environmental requirements. TNOs can draw from the experience and lessons learnt in other global transmission and distribution markets to challenge how project portfolios are planned, designed and constructed so as to realise the desired outcomes.

The need to better manage costs requires changing how projects are planned and implemented. No longer can TNOs afford to have capital plans developed through organisational silos. Rather, TNOs should plan using a whole system approach that quantifies system risks and prioritises investments based on those risks, following essential tenets of asset management. Integrated plans cut costs by aligning activities and potential synergies across a TNO’s operating units. Through early and close collaboration with the right supply chain partners, risk can be actively managed and minimised, removing stacked risk premiums and lowering the total cost of delivery.

AN ENGINEERING-LED APPROACH TO CAPITAL DELIVERY

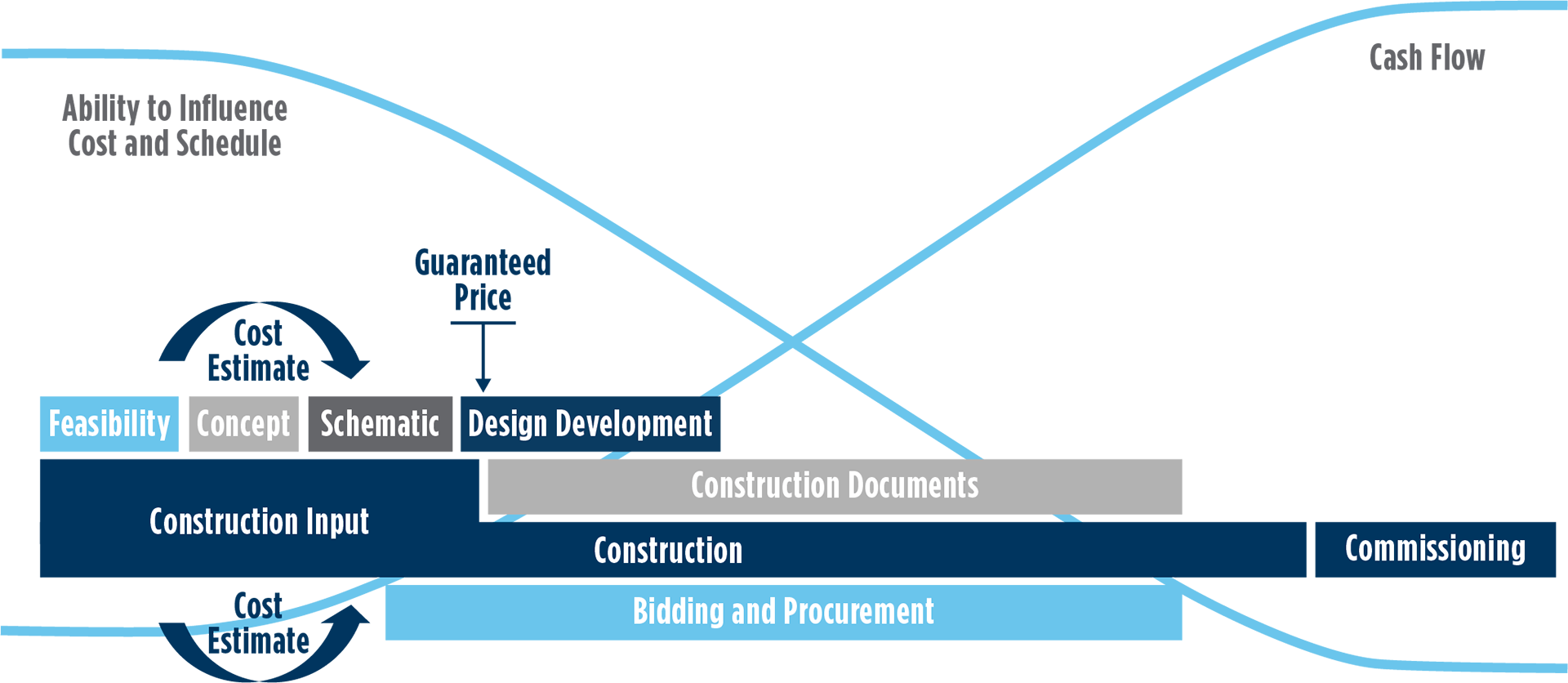

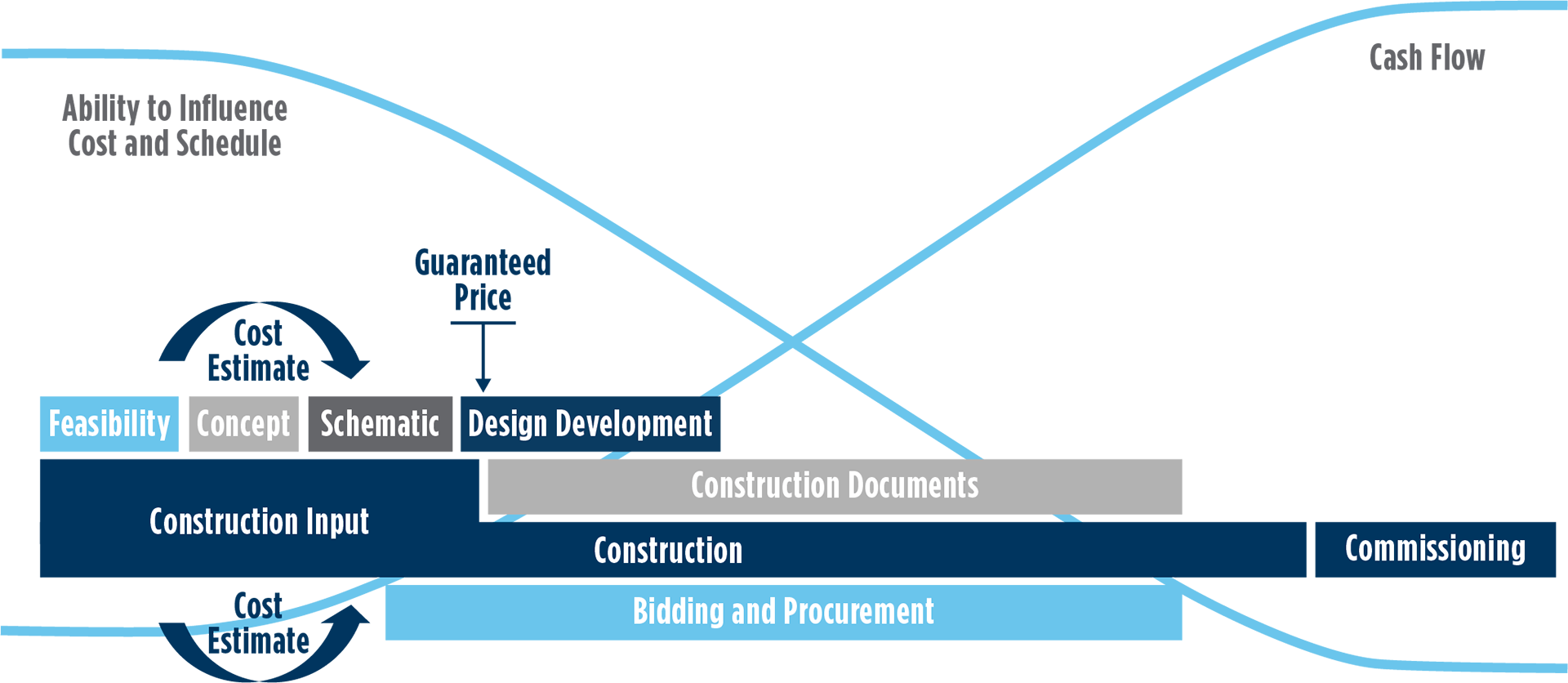

TNOs can further reduce total system costs by opening up their supply chains to new market participants and enabling greater flexibility in the design and construction process. Efficiency can be unlocked through earlier engineering engagement to enable new solutions for traditional problems. TNOs have typically followed prescribed practises to plan and implement capital investments. While these practises helped deliver previous price controls, traditional siloed frameworks do not provide sufficient flexibility to generate the required levels of cost savings. Every decision made at the outset of a project further limits engineering and construction partners’ ability to influence costs as programmes progress (as represented in Figure 1). For example, disaggregated supply chain models typically separate front-end engineering design (FEED) from delivery, under the opuses of different skill sets in the market and need for staged competition. Engineering with real construction inputs during the FEED process represents the greatest opportunity for cost reduction, but only if allowed to challenge the norm. During the FEED process, engineering and construction teams can assess the cost of preferential engineering standards against the expected risk mitigation and benefit. Real construction inputs enhance FEED for constructability, permit compliance and more accurate cost estimates, while holding those proposing the solutions to account for delivering upon the proposals.

FIGURE 1: Ability to influence cost and schedule over the project life cycle.

By enhancing flexibility throughout the design and construction process, TNOs will have access to proven solutions that mitigate risk and reduce costs. Enabling innovative delivery models, such as a partnered engineer-procure-construct (EPC) approach taking the FEED designer through into construction, can help realise the benefits of the savings and carry them through to utility performance — exactly what Ofgem desires.

- Networks business plan submissions: fourth quarter of 2019

- Final determination: fourth quarter of 2020

- Price control starts: April 2021

- Price control period: reduced to five years

- Cost of equity: halved to 4 percent

- Investment: increased hurdle rate for reinforcement

- Innovation: retain investment levels

REDESIGNING THE DESIGN PROCESS

Earlier engagement from the supply chain can unlock innovative yet proven design practises, align incentives, mitigate risk and provide greater cost certainty. Modular design, for example, reduces the time and cost to design multiple assets, both upgrades and new construction. Similarly, modular construction has been proven to improve quality and safety and mitigate schedule risks by building more complete assets or project elements in a factory setting. Coincidentally, modular construction also has helped alleviate skilled worker shortages, such as for welders, through the use of an assembly-line process. Design-for-value techniques enhance the transparency of the supply chain through early engagement, alignment of incentives, and a partnership approach that allocates risk to those in position to manage it.

Similar to pilot testing new technologies before widespread implementation, TNOs can pilot innovative delivery models and approaches for implementing their capital portfolio. Capital delivery as a service, similar to IT as a service, would enable TNOs to outsource traditional components of their portfolio and transfer risk. Third-party participants have the ability to identify and resolve inefficiencies that may not be apparent from inside the organisation. Another innovative delivery model involves hiring an overarching integrator. The integrator brings together smaller, specialist partners who collectively represent a broad capability set, providing clients with transparency of delivery and certainty of outcome across a wider portfolio of works.

DIFFERENT OUTCOMES REQUIRE A DIFFERENT APPROACH

Under RIIO-T2, cost certainty becomes critical for delivering on regulatory commitments and shareholder value. To meet disparate stakeholder needs, TNOs must also evolve their processes for planning and implementing capital programmes. Early engagement of the supply chain and the flexibility to unlock innovation throughout the delivery process will enable TNOs to manage risk and gain greater certainty over outcomes.

BIOGRAPHIES

JEFF CASEY, MIET, is the business development director and a senior electrical engineer for Burns & McDonnell in the U.K. Jeff has over 10 years of experience in the power and energy industry and has been responsible for helping clients deliver more than $16 billion (approximately £12 billion) in energy projects. He relies on his experience as an engineer and project manager to develop innovative and cost-effective solutions to his clients’ unique challenges. Jeff has a Bachelor of Science in electrical engineering from the University of Nebraska and a Master of Business Administration from New York University. He is an active member of the IET, CIGRE, CIRED and IEEE.

JONATHAN CHAPMAN, CEng, MICE, MIET, is the managing director for Burns & McDonnell in the U.K. Jonathan has more than 25 years of experience leading teams in securing and delivering projects in the power, water, telecom and gas sectors. He has been instrumental in enabling businesses to deliver complex solutions to client needs, working on programmes valued at £5 billion. Jonathan has a bachelor’s degree in civil engineering from the University of Bradford and an MBA in engineering management from Loughborough University.