By building standards-based private networks in an approved spectrum band, utilities can achieve cost certainty and better control over an ever-expanding and increasingly diverse network of critical assets at the far reaches of their system.

Telecommunications carriers are facing a technology revolution that disrupts longstanding business models and pushes them toward continual upgrade cycles just to keep up with customer expectations. The transition to 5G wireless broadband is just one example of the ever-changing nature of the evolving landscape. As public telecom carriers upgrade and push the limits of their networks, utilities are sometimes caught in the forward momentum, rushed into upgrades and early life cycle replacement of communications gear.

As the carriers rapidly build out their networks and retire their legacy assets, utilities are seeking opportunities to gain better forecasting and price certainty of devices deployed on these carriers’ infrastructure. With some utilities presently managing over 500 truck rolls per month to install new cellular devices in the grid, the need for a long-term wireless strategy is clear. Considering PLTE makes the equation for life-cycle costs more predictable and introduces a new level of control to the balance sheet.

LTE is the wireless standard commonly associated with “4G” or “5G” wireless communications. This worldwide standard has been developed by the cellular industry consortium called the 3rd Generation Partnership Project (3GPP). This “long-term evolution” technology is indeed exemplary of its name and continues to evolve. Improvements on the technology to increase speeds, lower latency, improve spectrum utilization and capacity, as well as increase security, are constantly being made to support the vast device ecosystem.

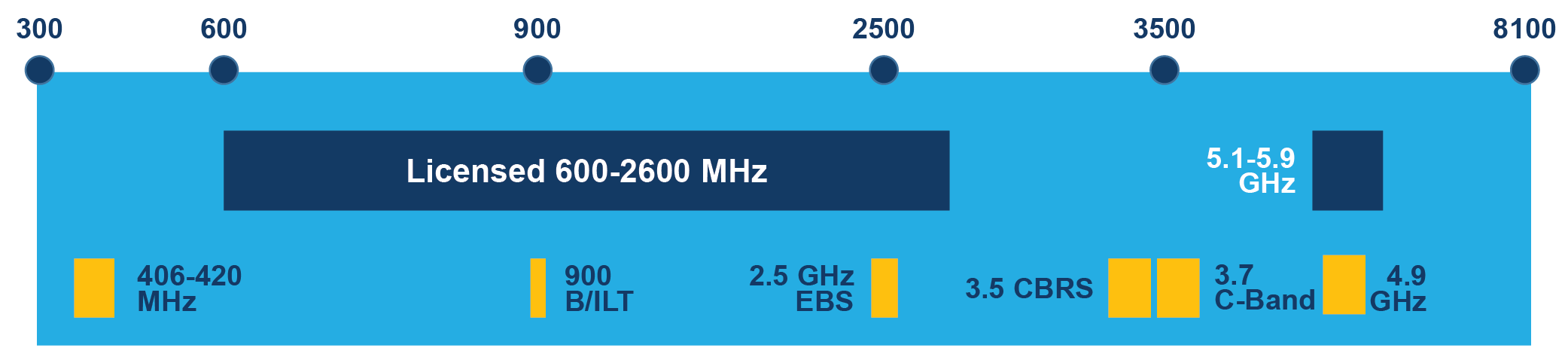

As the push toward utilizing LTE technology moves into the private sector, more and more spectrum is being allocated for the LTE bands. As utilities have long asked for special spectrum allocations, the Federal Communications Commission (FCC) has made clear that it will not allocate spectrum for any specific industry but will allow new allocations to go into the open market. In the first half of 2020, the FCC approved re-banding 6 MHz of the 900 MHz narrowband spectrum for broadband private LTE communications. This ruling, along with the Citizens Band Radio Service (CBRS) auction, has sparked increased interest from utilities that until recently had limited spectrum options.