INTRODUCTION

Within in the last few years, there have been major changes to the U.S. power supply proposed by various state and federal regulatory bodies, as well as the industry as a whole. The Reforming the Energy Vision (REV) strategy in New York state, the Distribution Resource Plan requirement in California and the federal Clean Power Plan (CPP) have made a renewable and distributed energy future part of U.S. energy policy. These initiatives either have been put on hold, as with the CPP, or have progressed, like in New York and California.

As stated in Renewable Energy World, renewable energy sources now make up more than 17 percent of the total installed operating generating capacity in the U.S. If it’s business as usual moving forward, those numbers will greatly increase. Forbes posted an article by Energy Innovation’s policy design projects manager that predicts solar will comprise 21 percent of total installed capacity in the U.S., and wind 14 percent, by 2050. However, these changes will not happen without some complex changes to the electric (legacy) grid. Versatile resources, such as energy storage, will aid the renewable future by providing reliability and resiliency to the dynamic grid.

Nowhere does the growth and adoption of renewable energy continue to be more prevalent than in California, with the recent update to Senate Bill 100 (SB 100), where the state has committed to using renewable resources for 100 percent of its electricity generation by 2045. This builds on the state’s previous target of achieving 50 percent renewables by 2030. The California Public Utilities Commission (CPUC) has committed to accelerating the adoption of energy storage to support the renewable energy initiative. Assembly Bill 2514 (AB 2514) and AB 2868 mandate that California’s Investor-Owned Utilities (IOUs) procure 1.825 gigawatts (GW) of energy storage by 2020. The bill’s progress to date already has led to conversations about a CPUC-mandated third round of energy storage procurement after 2020.

Outside of California, PJM Interconnection (PJM), a regional transmission organization (RTO) serving states in the central and eastern regions of the U.S., also has experienced increased activity in the storage market in recent years. In 2014, two-thirds of all storage deployed in the U.S. was in the PJM territory. In 2017, PJM had more than 340 megawatt-hours (MWh) of grid-scale storage options, and it remains highly active in the adoption of such technology. The growth, however, has been driven by economics rather than regulation. The dynamic regulation signal market (RegD) has stimulated tremendous growth in the amount of energy storage assets deployed within the PJM service territory, as opposed to using traditional diesel generators to participate in this new market.

In addition to developers who have aggressively deployed storage on the grid, utilities around the country are exploring energy storage investment opportunities. This has prompted several research and development projects to evaluate the value of energy storage on the grid. While some utilities have traditionally been viewed as slow adopters, companies like Duke Energy are beginning to change that perception. In April 2016, Duke Energy announced it was ready to start deploying energy storage projects within the regulated market; in October 2018, the company announced it would invest $500 million in battery storage. The adoption of energy storage at Duke Energy showcases a significant step toward the expansion of this market.

In addition to complementing and enabling the nation’s renewable future, energy storage will be a fundamental part of the next generation distribution system by improving operational capabilities of the grid. The growth of this market largely has been driven by state mandates, but in 2018, federal policy provided a major leap in the market with FERC Order 841.

POLICY

Order 841, approved in February 2018, directs RTOs/independent system operators (ISO) to come up with market rules for energy storage to participate in wholesale energy, capacity and ancillary auction markets. Order 841 makes sure that markets recognize the physical and operational characteristics of an electric storage resource (ESR), allowing RTOs/ISOs to buy or sell into the market (inject energy or receive energy). FERC specifies that those rules must meet the following:

- Establish ESR market participation model for eligible ESRs to provide all capacity, energy and ancillary services they are technically capable to provide.

- Make sure ESRs can be dispatched and set the wholesale market clearing price as both a wholesale seller and wholesale buyer.

- Clearing price: the highest price that must be paid to service enough supply to meet demand so supply equals demand.

- Account for ESRs’ physical and operational characteristics through bidding parameters or other means.

- Establish a minimum market participation size requirement (not to exceed 100 kW).

- Specify the sale of electricity from the RTO/ISO markets to a storage resource that the resource resells must be at the wholesale locational marginal prices (LMP).

- Storage resource is permitted to offer less than its nameplate capacity (de-rating) to meet minimum runtime requirements.

- In some capacity markets, a resource must meet a minimum run-time duration (for example, four hours in the New York ISO). This can be challenging for storage resources that can’t run for that long.

Federal policy created major waves in 2018, but states are doing their part, too, by continuing to adopt and/or build on previous mandates. California updated its aggressive renewable portfolio standards (RPS) goals with Senate Bill 100 (SB 100) on Sept. 10, 2018, which created new standards for previous RPS goals established under SB 350. It most notably establishes that 100 percent of all electricity in California must be obtained from renewable and zero-carbon energy resources by 2045.

Not only are coastal states such as California, New York, Oregon and Massachusetts growing their aggressive targets but some central states also are following suit. The Colorado General Assembly passed SB 18-009, establishing the right for consumers to install energy storage on their property. In addition, the state passed HB 18-1207, which directs the state’s public utility commission (PUC) to include energy storage in its respective utilities’ planning processes. In 2017, Nevada commissioned a study to investigate whether it would be in the public interest to require energy storage procurement by the state’s utilities. Advocates believe this potential change would align with the state’s current RPS goal of 25 percent by 2025. Currently, the state is considering increasing its goal to 50 percent by 2030.

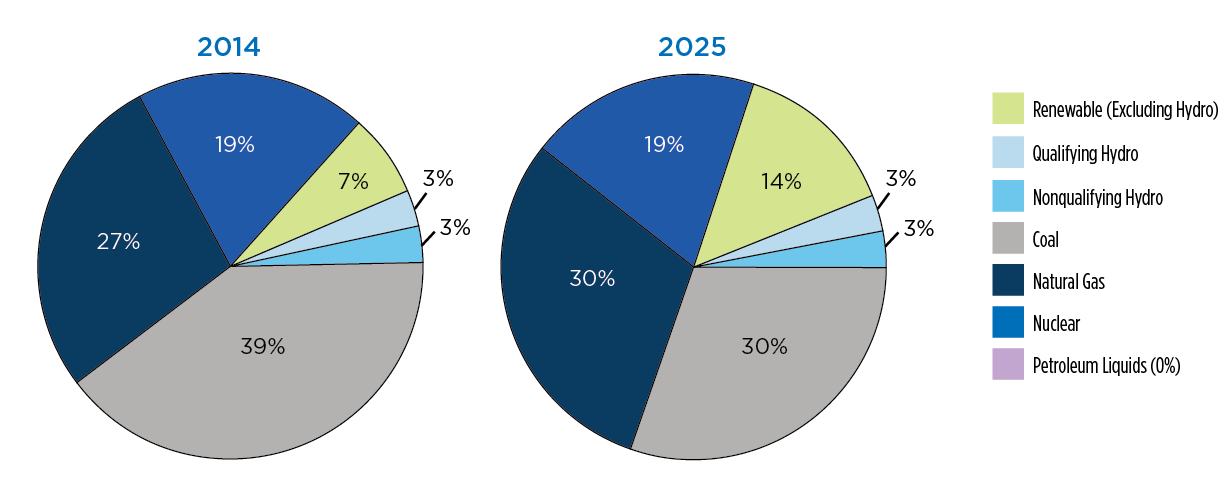

The renewable and energy storage markets are considered by some to be complementary. Though either can be effective without the other, an increase in renewable energy naturally can lead to an increase in energy storage needs. Several of the policies mentioned within this paper continue to have a direct correlation to the deployment of energy storage assets. Regardless of the implementation of RPS goals, coal is being phased out as a primary fuel source of the United States’ power supply. The graphs in Figure 1 show the Energy Information Administration (EIA) 2014 report versus projections of the country’s electricity generation mix. The administration predicts a 100 percent increase in the renewable generation portfolio by 2025, while the demand for coal is estimated to decrease by 23 percent. This is a sign of continued growth and interest in renewable energy and, therefore, the additional infrastructure required to support a renewable energy future.

FIGURE 1: Progression of total U.S. generation mix: 2014 (left) and projected 2025 (right). Renewables (excluding hydro) were 7 percent of generation in 2014, expected to increase to at least 14 percent by 2025. Sources: Goldman Sachs Global Investment Research, EIA.

While policy at the state and federal levels has been impactful in 2018, there are still significant challenges that must be addressed to propel the market. Nevertheless, policy for energy storage is on the right path, creating opportunities for wide deployment in the years to come.

GRID APPLICATIONS

Energy storage does not fit neatly within the traditional electric utility organizational silos of generation, transmission and distribution. Instead, energy storage assets offer the opportunity to contribute and provide value across multiple utility organizations and markets. Oncor tried to break the traditional model when it sought regulatory approval to procure 5 GW of energy storage on the grid. This proposal was based on the Brattle Report, which noted an increased System Average Interruption Duration Index (SAIDI) rating improvement on its transmission system. While it could have been an option, Oncor indicated it did not intend to participate in the generation market, likely to appease legislators. While thus far unsuccessful, Oncor and other Texas utilities are lobbying to change Texas law to allow storage as a transmission asset.

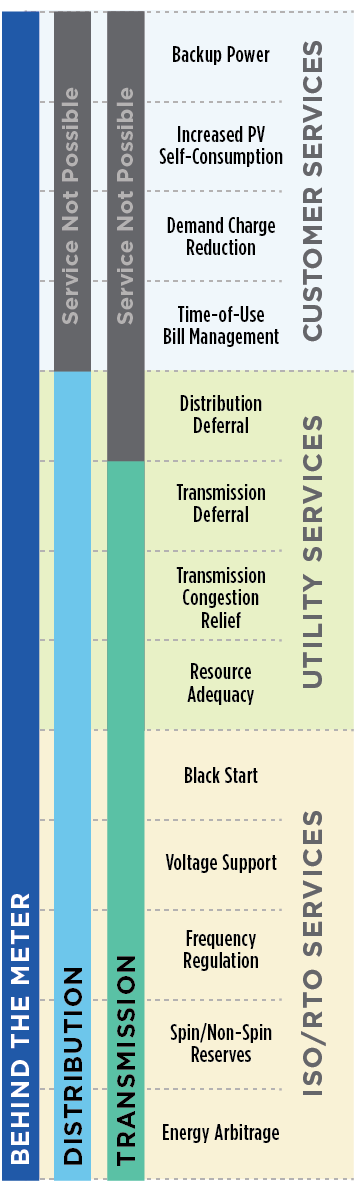

Headquartered in Basalt, Colorado, the Rocky Mountain Institute has identified use cases and stakeholder groups involved at all levels of energy storage systems. Its study identified 13 different electricity services within three major stakeholder groups (ISO/RTO, Utility, and Customer), shown in Figure 2. According to the report, customer-sited, behind-the-meter energy storage offers the largest number of services to the grid, even if this is not always the lowest-cost option. Further, the study indicates that an energy storage asset must provide multiple, stacked services to optimize its value.

FIGURE 2: The economics of battery energy storage. Batteries can provide up to 13 services for three stakeholder groups. Source: Rocky Mountain Institute.

The following sections examine benefits delivered by each service — ISO/RTO, Utility, and Customer — to the grid, according to the institute’s report.

ISO/RTO SERVICES

Energy Arbitrage: The most commonly associated service when it comes to energy storage, energy arbitrage is purchasing wholesale electricity while the price is low and selling the electricity back to the grid when the price is high.

Frequency Regulation: This is the immediate response of power to a change in locally found system frequency. Batteries can provide instantaneous balance to prevent system-level frequency peaks and valleys, which cause instability in the grid.

Spin/Non-Spin Reserves: A spinning reserve is a generation asset that is always online and able to provide immediate load, should an unplanned outage occur. A non-spinning reserve can respond rapidly, although not instantaneously, to an unplanned outage.

Voltage Support: This service maintains a continuous flow of power across the grid. Generation sources, such as solar, need additional voltage support for proper power flow.

Black Start: In the event of a grid outage, black start resources are used to restore operation to larger power facilities to get the grid back online. Many larger generation facilities have black start resources incorporated into their systems.

UTILITY SERVICES

Resource Adequacy: With this service, energy storage would replace peaker power plants to provide enough electricity during peak hours. This service would naturally combine with energy arbitrage.

Distribution Deferral: This service delays or avoids the need of additional distribution wire assets and helps prevent overbuilding of the system to handle peak days that are often predictable in nature. Also, this alleviates budget constraints for investment elsewhere.

Transmission Congestion Relief: Transmission corridors can become congested during certain parts of the day; by deploying energy storage downstream from the congestion, the asset can help compensate for the undersized transmission asset.

Transmission Deferral: Like distribution deferral, this service delays or avoids the need for additional transmission wire assets. It also helps prevent overbuilding of the system to handle peak days that are often predictable in nature. In addition, this alleviates budget constraints for investment elsewhere.

CUSTOMER SERVICES

Time-of-Use Bill Management: This service minimizes peak hour electricity consumption by complementing traditional power flow with an energy storage asset. This is similar to energy arbitrage, but with behind-the-meter customers.

Increased PV Self-Consumption: The consumer can use photovoltaics to harness the benefit of renewable energy.

Demand Charge Reduction: In the event of a grid outage, energy storage paired with a local generator can provide backup power for industrial, commercial and residential customers. Demand charge is an additional compensation to the utility for maintaining a sufficient level of capacity for transmission and distribution.

Backup Power: In the event of a grid outage, energy storage paired with a local generator can provide backup power for industrial, commercial and residential customers.

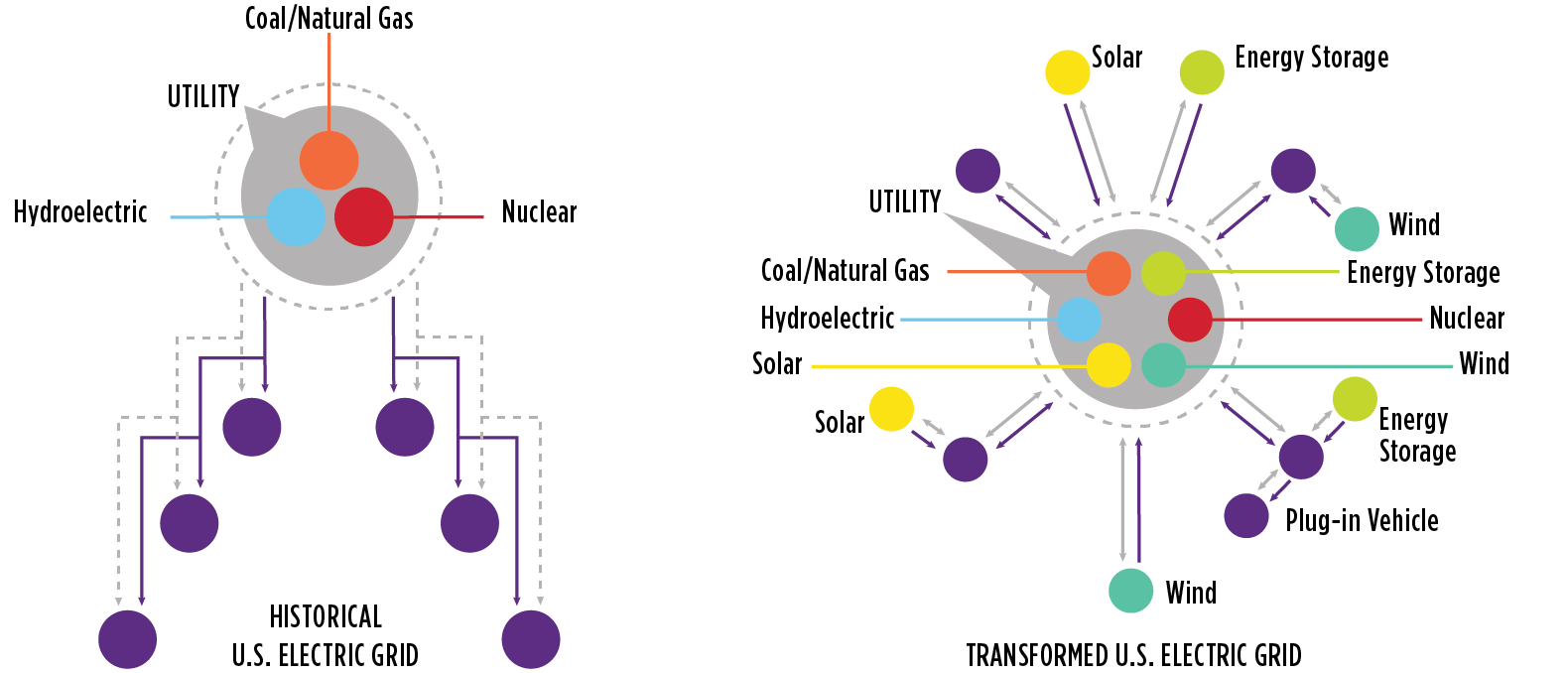

With changing load conditions and distributed generation, there is a need for a dynamic grid that can adapt quickly with the changing times. Figure 3 shows the transformation of U.S. energy resources. As the complexity of generation resources increases, so must the grid that delivers electricity. Adopting and accommodating a new model is an important step in realizing the full value of energy storage on the grid. The value of the versatility of storage solutions is giving operators unique flexibility to break the traditional utility silos and provide a resource adequate for the changing times ahead.

FIGURE 3: From hierarchical to flat: energy and utility IT and OT. Source: IBM.

CONTINUED MARKET GROWTH POTENTIAL

Among factors contributing the market’s growth: expanding state mandates, ongoing federal policy, declining costs, and increasing manufacturing capacity. Regulatory reform, in 2018, is the most recent contribution.

As mentioned by the Energy Storage Association (ESA), “the exact nature and timing of this transformation is debatable, but all stakeholders agree that the inherent ability to safely and affordably store energy will produce significant, measurable benefits across the U.S. economy and vastly expand the value of the electric grid.”

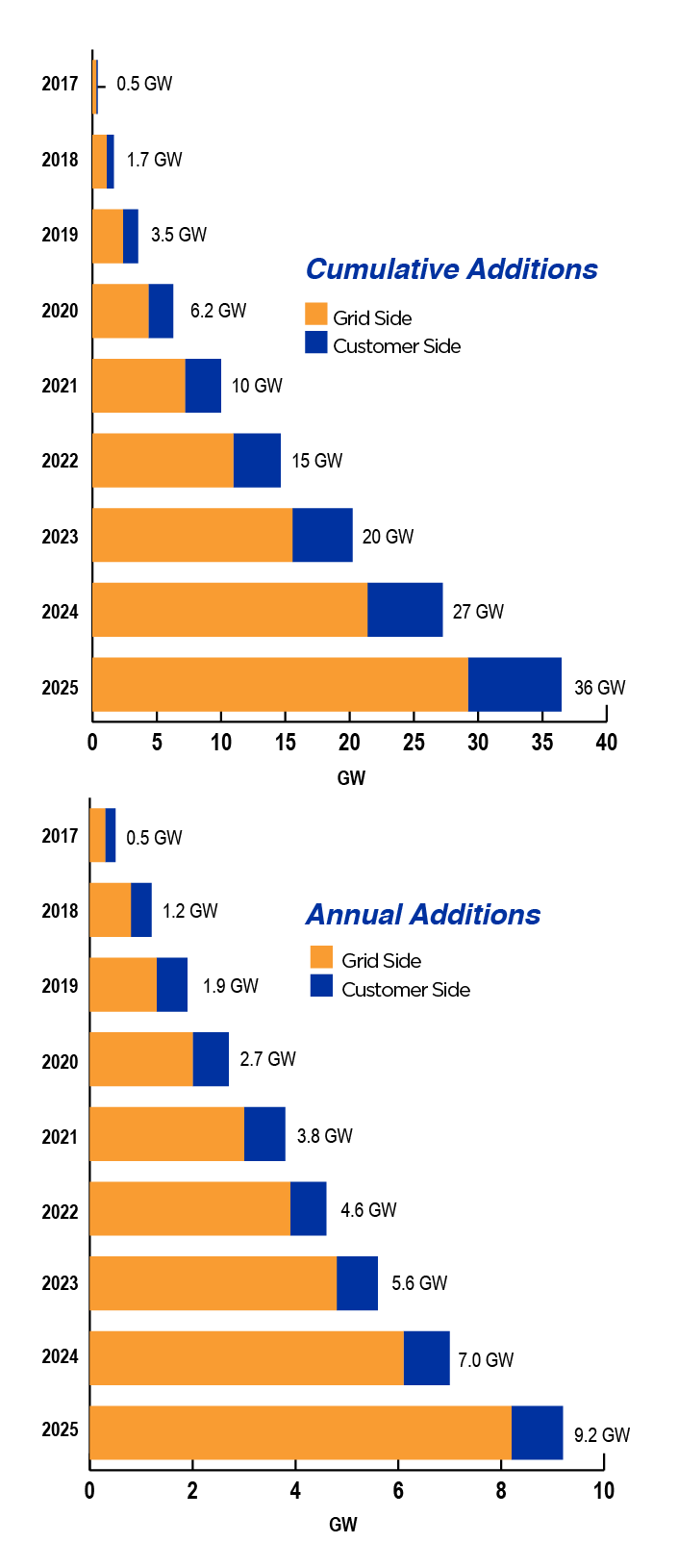

A few years ago, Goldman Sachs asserted the total addressable market of grid-scale energy storage to be somewhere between $100 billion and $150 billion. This report was corroborated by a separate study completed by research firm HIS, estimating the total market potential for batteries to be greater than 100 GW by 2030. A 2017 report by the ESA, in conjunction with Navigant Research, describes how a confluence of forces and continued advancement in grid planning and operations will drive the deployment of more than 35 GW of new, cost-effective advanced energy storage systems in the U.S. by 2025. See Figure 4 for more details.

FIGURE 4: Cumulative and annual U.S. energy storage power capacity additions, vision case 2017-2025. Source: Energy Storage Association.

These projections, paired with existing storage systems in service, have proven to be cost-effective, scalable and adaptable to the needs of the regions they serve.

CONCLUSION

The paradigm continues to change to a more integrated and market-friendly industry with large centralized generation fading away. Today’s system is challenged by disruptions of all types, but it’s inherent to adapting to rapid changes in network conditions. Stakeholders and industry leaders are working toward building a reliable and resilient system that can handle the current dynamic disruptions while keeping rates low. Low rates, which will always be most important, are the cornerstone of the industry.

Storage projects today have proven to be cost-effective solutions that are scalable and adaptable to the needs of the regions they serve. As reliable and resilient resources, they are helping improve grid management options for utilities. With technology — and demand — rapidly evolving, energy storage will continue to be a complementary and natural component of a renewable energy future.