WHITE PAPER / IMPROVING RETURNS FROM WIND INVESTMENTS

BY Aaron Anderson, PE

The price for wind energy in Mexico has become increasingly cost-competitive with U.S. rates. However, with U.S. Production Tax Credits (PTC) set to expire in 2020, Mexico-based projects may become more cost-effective to build and operate. With demand for clean energy growing, cross-border opportunities can help wind developers and investors.

✖

✖

Mexico currently spends more than $5 billion per year importing natural gas from the United States, a figure that is projected to double by 2022 when construction of three new pipelines is complete. However, the Mexican government has set goals and policies to transition the country from being a net importer of energy to a net exporter. Wind energy provides a significant opportunity to export energy from Mexico to the U.S., particularly in areas directly across the border from larger cities or loads.

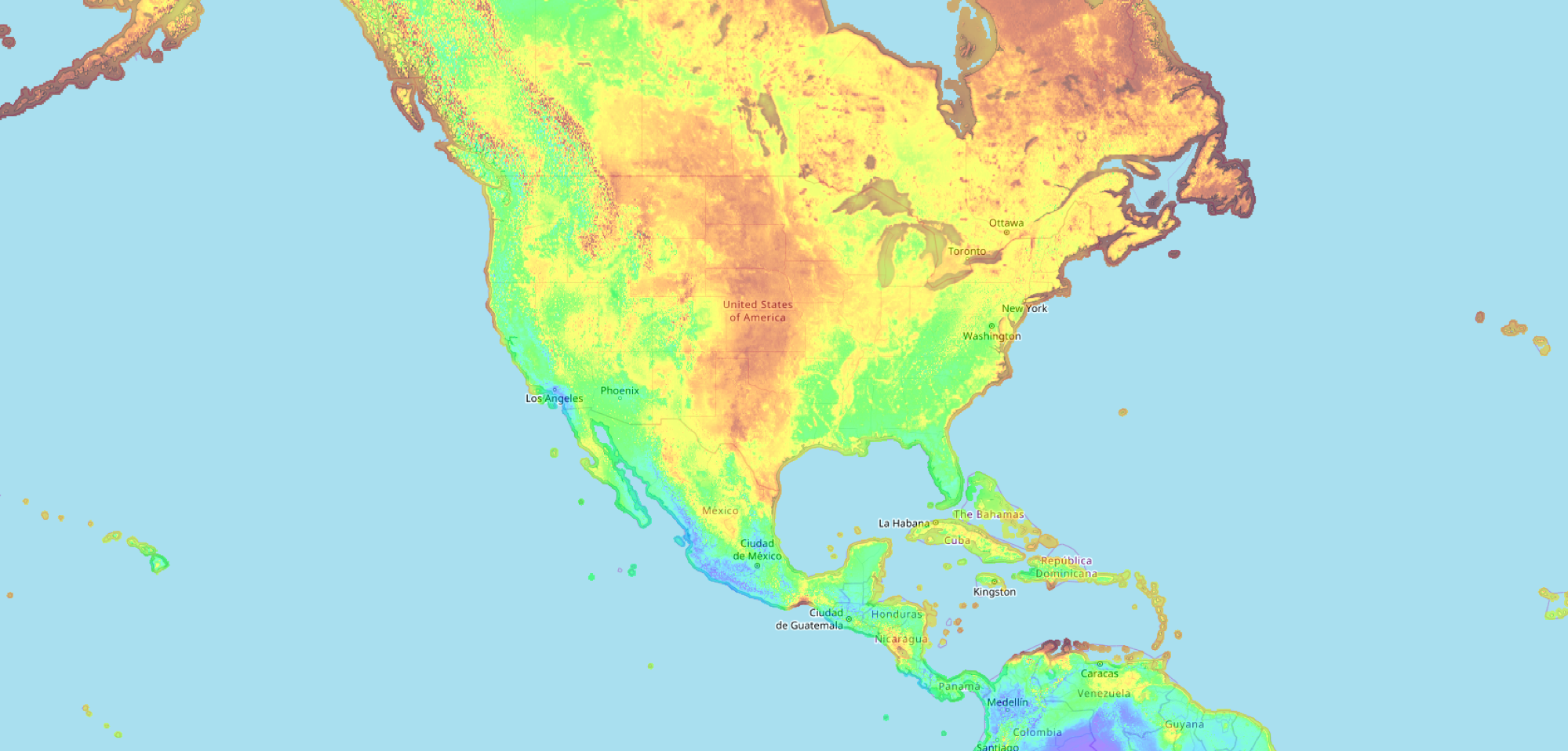

A map of average wind speeds across the southern U.S. and Mexico (Figure 1) shows areas, in orange and red, where wind speeds across the central corridor of the United States are very strong, corresponding with locations of the majority of operating wind farms in the U.S. Similarly, Mexico’s strongest wind resources are in Oaxaca, along the southwestern coast; approximately 60 percent of Mexico’s installed wind capacity is located there. However, other pockets of strong wind speeds can be found along the U.S. border, particularly in the Mexican states of Baja California and Tamaulipas.

Mexico currently spends more than $5 billion per year importing natural gas from the United States, a figure that is projected to double by 2022 when construction of three new pipelines is complete. However, the Mexican government has set goals and policies to transition the country from being a net importer of energy to a net exporter. Wind energy provides a significant opportunity to export energy from Mexico to the U.S., particularly in areas directly across the border from larger cities or loads.

A map of average wind speeds across the southern U.S. and Mexico (Figure 1) shows areas, in orange and red, where wind speeds across the central corridor of the United States are very strong, corresponding with locations of the majority of operating wind farms in the U.S. Similarly, Mexico’s strongest wind resources are in Oaxaca, along the southwestern coast; approximately 60 percent of Mexico’s installed wind capacity is located there. However, other pockets of strong wind speeds can be found along the U.S. border, particularly in the Mexican states of Baja California and Tamaulipas.

FIGURE 1: Map of average wind speeds across North America in meters per second. Source: International Renewables Energy Agency, irena.org

Similar to the U.S., Mexico’s strong wind resources are not located near major load centers, making transmission and the ability to move power a key component of a project’s viability. While plans are underway to build new, large-capacity transmission lines from these areas along the border toward the central Mexican grid, the timing of building these large transmission projects remains in question, favoring cross-border projects for the foreseeable future.

Pricing has been and always will be a primary factor in the viability of any type of generation project. During the past three years, CENACE (the National Center for Energy Control in Mexico) organized a series of auctions, the results of which have been unquestionably positive. The initial auction, conducted in 2016, included 17 projects: 12 solar and five wind generation facilities. The price result for these resources was approximately $51 per megawatt-hour (MWh) for solar and approximately $59 per MWh for wind. One month after the initial auction, CENACE released a second tender, and the results showed price improvement with more than 80 companies submitting bids. The price of wind fell to approximately $38/MWh.

In November 2017, CENACE released the results of its third auction, which saw a technology-wide average of approximately $20.60/MWh and one wind bid as low as $17.70/MWh. A fourth auction was scheduled for November 2018, but it has been postponed indefinitely by Mexico’s new administration. Regardless of when the fourth auction is held, the results of the auction process show the price for wind energy in Mexico is already rivaling current U.S. pricing, when removing the U.S. Production Tax Credits (PTC) from the equation. This price differential could make a cross-border project — a facility built in Mexico that sells power to the U.S. — more profitable for the potential owner, particularly after the PTC expiration. However, such projects do require a cross-border transmission line. Such lines require a Presidential permit from the U.S. State Department if selling into the United States, which can take considerable time to acquire.

Burns & McDonnell was selected as owner’s engineer for the first cross-border wind farm project in Mexico that sells power to the United States. The project, completed in 2015, is located in the Sierra de Juárez mountain range in Baja California. Power generated by the facility is supplied to San Diego Gas & Electric and supports efforts to meet California’s requirement to get half of its electricity from renewables by 2030. A 4.8-mile transmission line supplies power from the wind farm to Southern California.

Developing a wind project in Mexico is similar to developing one in the U.S. Key components involve identifying a site for the project; identifying an off-taker; and identifying how to move power from the generation site to the off-taker. Time and cost to construct your project could be dramatically different from one side of the border to the other, though.

Transmission is a significant factor. As the transmission system continues to expand, this factor will likely change in its importance. Currently, transmission in Mexico is a significant bottleneck that favors cross-border projects.

Location is another key consideration. Baja California is much more development-friendly than just a few miles north in southern California. As a result, getting the same project permitted in Mexico versus California can be substantially easier.

Price is perhaps the primary factor. With the looming expiration of the PTC, the playing field between the neighbors’ prices for wind energy will be significantly leveled. The last CENACE auction, which resulted in pricing as low as $17.70/MWh for wind, was without any type of subsidies or PTC that a U.S.-based project would receive. Many in the industry are accustomed to seeing wind prices in the low- to mid-teens in the windiest parts of the United States, but these are all subsidized. This means wind power in Mexico is arguably already more economical to build and operate than it is in the U.S.

Any cross-border generation project will require significant coordination and advanced planning. Such projects require specialized permits, additional permits in two countries, contractors with licenses to work in multiple jurisdictions and both countries, and other challenges that a project located and selling within a single country would not have.

Terrain is another consideration. The Energía Sierra Juárez Wind Farm in Baja California made sense in large part because it only required less than 5 miles of transmission line to the point of interconnection to the grid. However, to get from one end of this line to the other requires an approximately 2-hour commute due to the lack of roads in the remote area and the border crossing. Thanks to these and other factors, not all cross-border projects will be financially feasible. However, in the right environment, such projects could be extremely successful.

There are many factors within the Mexico power market that the industry should watch as investors and developers put together their investments and programs. Pricing in Mexico fell by nearly 50 percent within about 18 months of CENACE’s first auction. Pricing is likely to continue to drop even further within the U.S. and in Mexico. The impact of the expiring PTC could dramatically increase interest in wind development in Mexico as a means for investors to put capital to work and maximize their return on investment.

Industry participants should closely follow the future of each country’s investment in infrastructure. Based on current plans that focus significant investment in transmission lines and substations, Mexico appears to be leading the way in making available more opportunities for generation-based projects. While cross-border projects will not solve all of Mexico’s — or the United States’ — energy challenges, there are niche locations along the border with strong wind speeds that are favorable for development and the savvy investor.

Interested in learning more?

✖

© 2025 Burns & McDonnell. All Rights Reserved

At this time, Burns & McDonnell is not offering pure architectural services in the states of Illinois, Louisiana, Montana, Nevada, New Hampshire or New Jersey. We may, however, provide design-build services for architectural projects.