THE EFFECT OF DISTRIBUTED ENERGY RESOURCE NEEDS

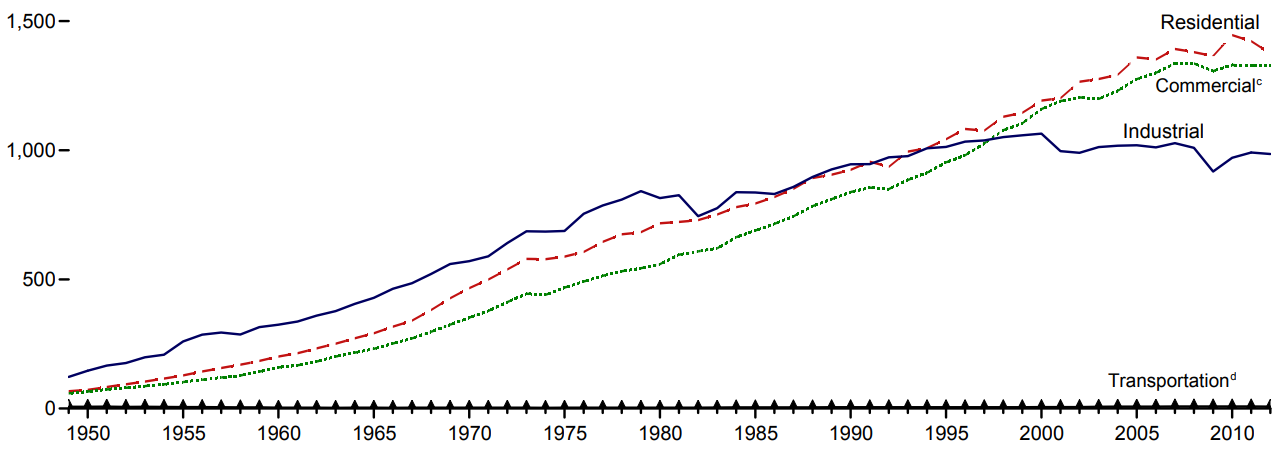

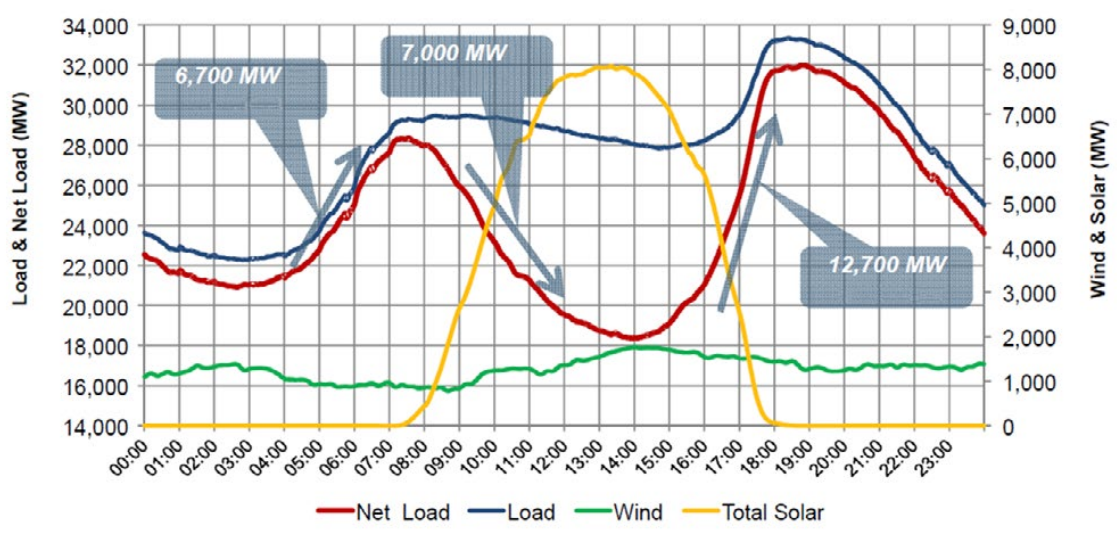

Localized grid factors are also driving the need for distributed energy resources, and reciprocating engines are competitive in that arena. Electric loads are typically connected at voltages under 230 kV, and extra-high voltage transmission systems often do not provide voltage support to lower levels. Renewable energy sources are also commonly connected under 230 kV, and often at distribution voltages. In areas where renewable sources are clustered and transmission constraints exist, flexible generating assets can help mitigate the impact of intermittent electricity resources.

For example, wind farms are common in the middle of the country, in areas that also tend to be sparsely populated, so wind farms may be a significant portion of the local generation profile. LSEs need to balance those systems, but they likely have a much higher area control error (ACE) than an ISO, so flexible generation assets may be critical at lower voltages. In those areas, the fast start times and ramp rates of reciprocating engines, along with the ability to scale the installation linearly by reducing the number of engines at a given site, are well suited to “follow the wind,” maintaining desired output and frequency.

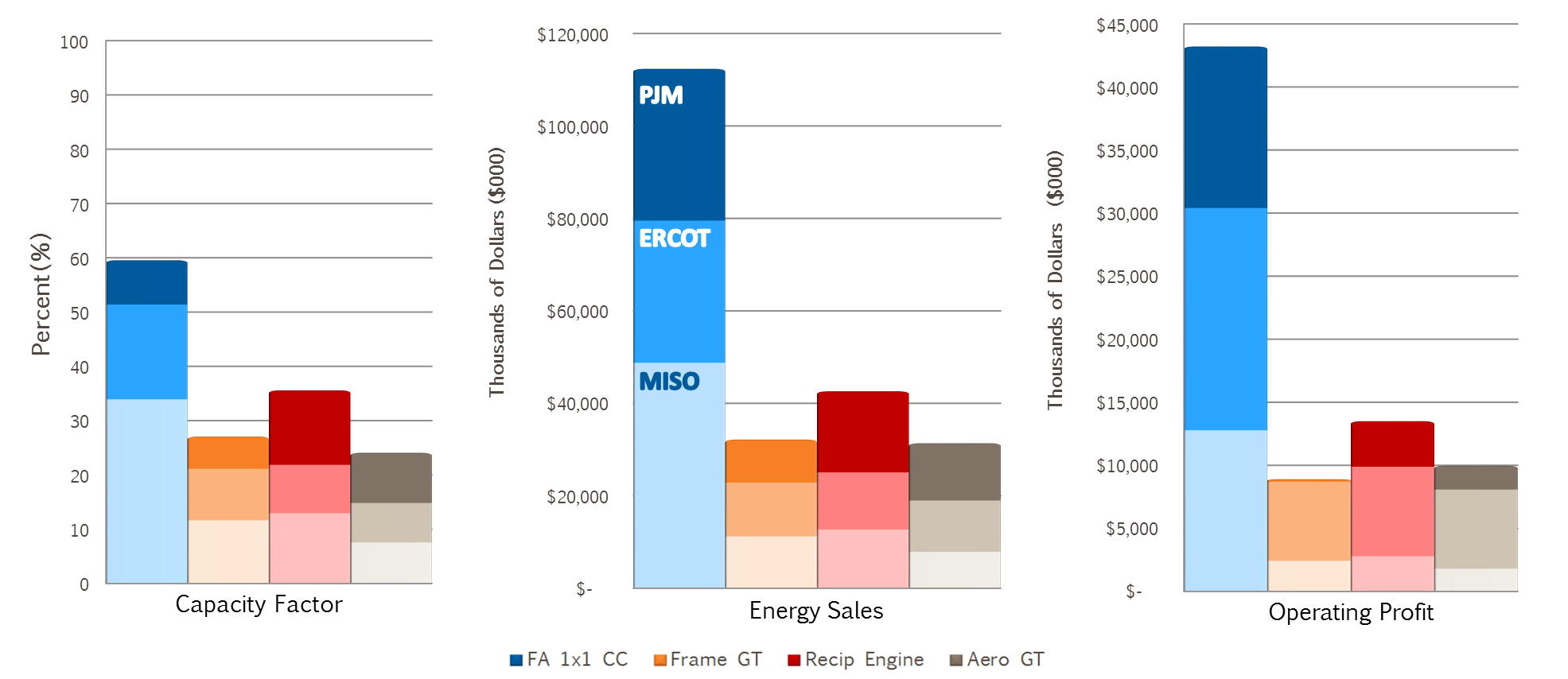

The technological benefits of reciprocating engines are evident for flexible peaking applications, but supply and demand drive the success of the plant, as demonstrated in an indicative economic analysis. For the example plant options introduced earlier, generation revenues were evaluated based on a production cost model (PROMOD IV) simulation using historical data from 2011 to 2014 in MISO, ERCOT and PJM. Essentially, the evaluation shows generation revenues according to the dispatch results during the study period.

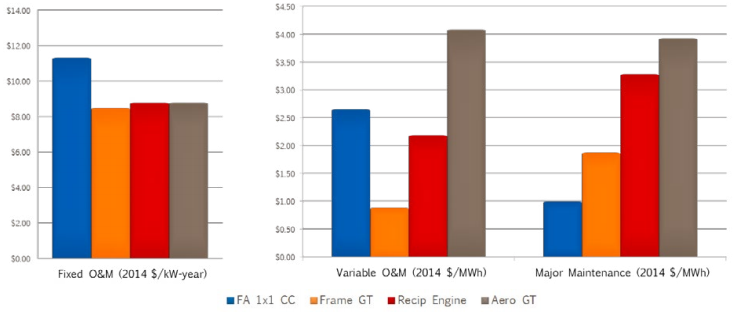

In Figure 5, the expected annual operating and maintenance (O&M) costs plus major maintenance costs are shown. Fuel is excluded from variable O&M. On a $/kW basis, there is little differentiation among fixed O&M costs for the peaking options.

Variable O&M rates are highest for the aeroderivative option, largely due to costs related to demineralized water consumption. Note that the aeroderivative model can be selected with dry combustors and fin fan cooling to minimize water consumption. That model would be expected to have variable O&M costs of approximately $1.50/MWh, but the output at summer conditions would be more than 10 percent less. The reciprocating engine plant requires very little water, measured in gallons per week, for cooling loop makeup. However, there is routine, minor maintenance on the engines plus SCR reagent and catalyst replacement considerations.

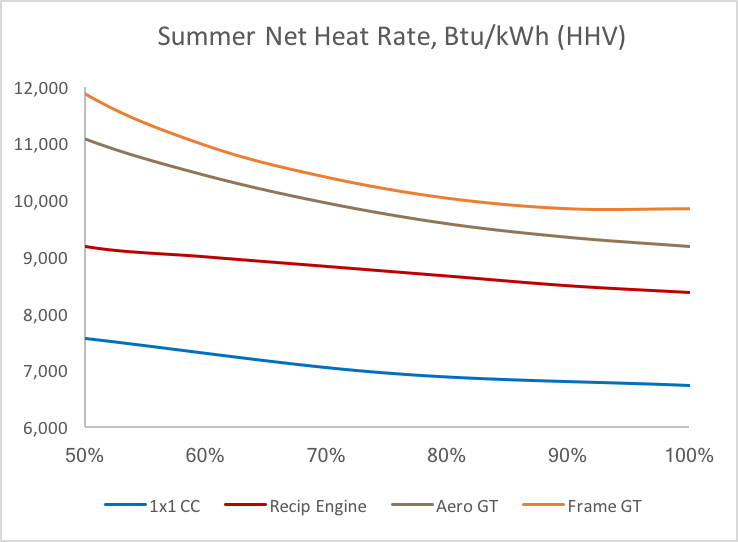

Figure 6 shows the comparative energy revenues based on the model results from three example ISOs broken out by color shading. The superior heat rate of the reciprocating engines allows for a higher capacity factor than the other peaking options, and therefore, better energy sales. The combined-cycle shows indicative comparison between peaking and intermediate dispatch applications. There are applications for intermediate dispatch of reciprocating engine plants where a combined-cycle may not be financially prudent. In direct competition at higher capacity applications, the combined-cycle will generate more revenue due to its superior heat rate.

.png?width=175&name=azco-white-logo-2020%20(1).png)