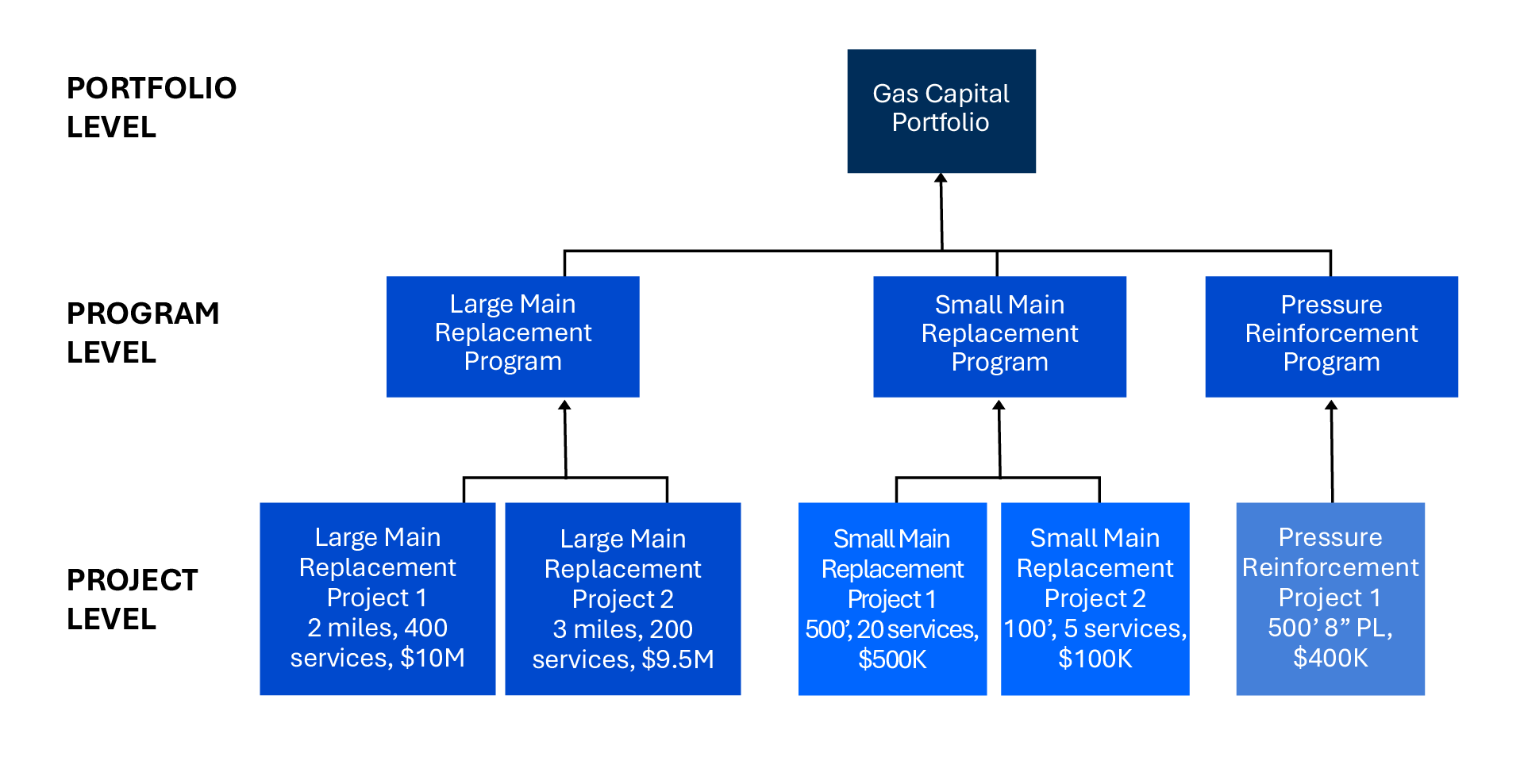

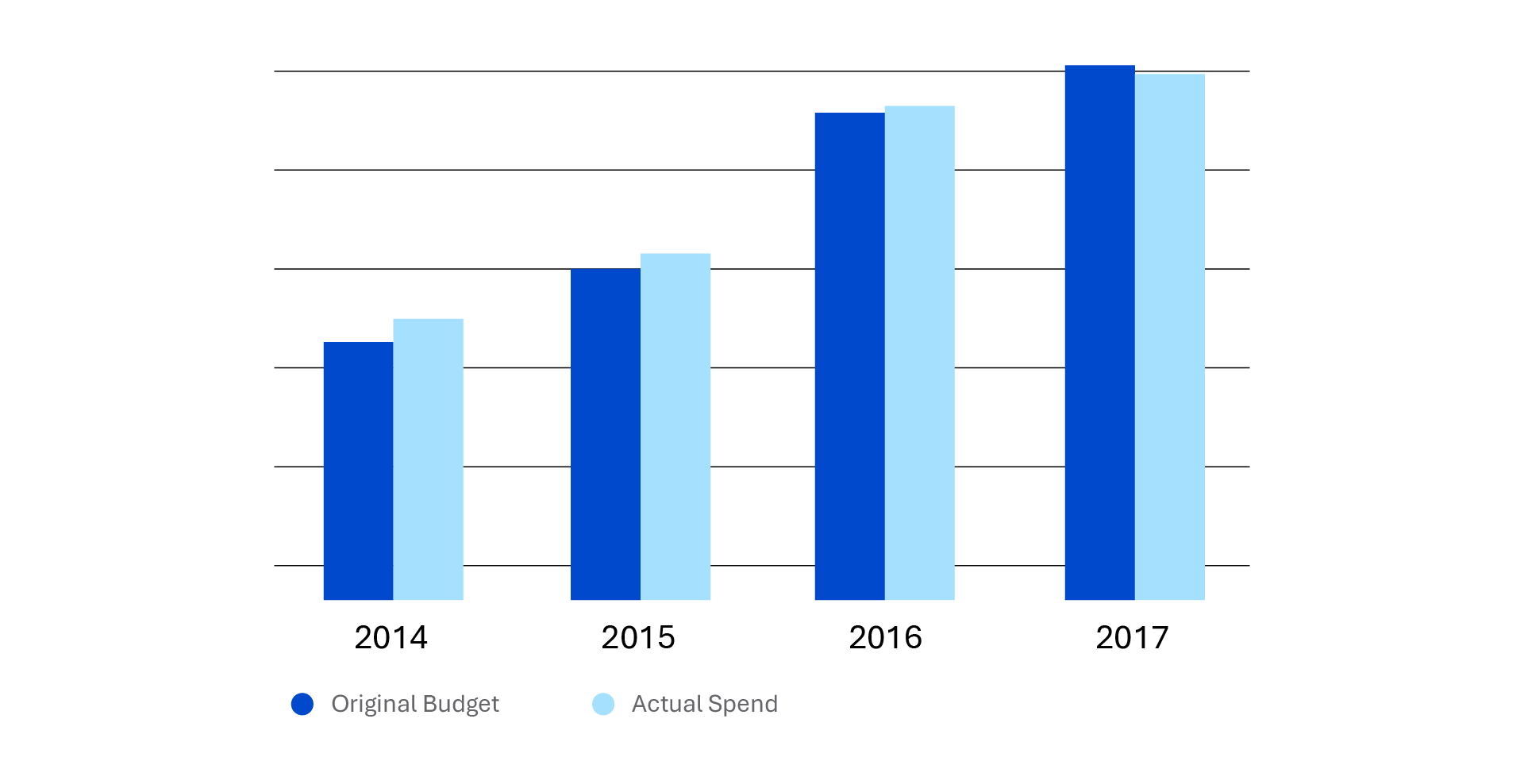

With detailed forecasts created for each project, activities can be reviewed and adjusted at the program and portfolio levels, making up the top-down assessment of the forecast. The top-down view of the MRP allows several advantages and project control benefits, including:

- Making sure programs are meeting scope and spend targets, and providing an at-a-glance understanding of activity, schedule and budget for each program and portfolio.

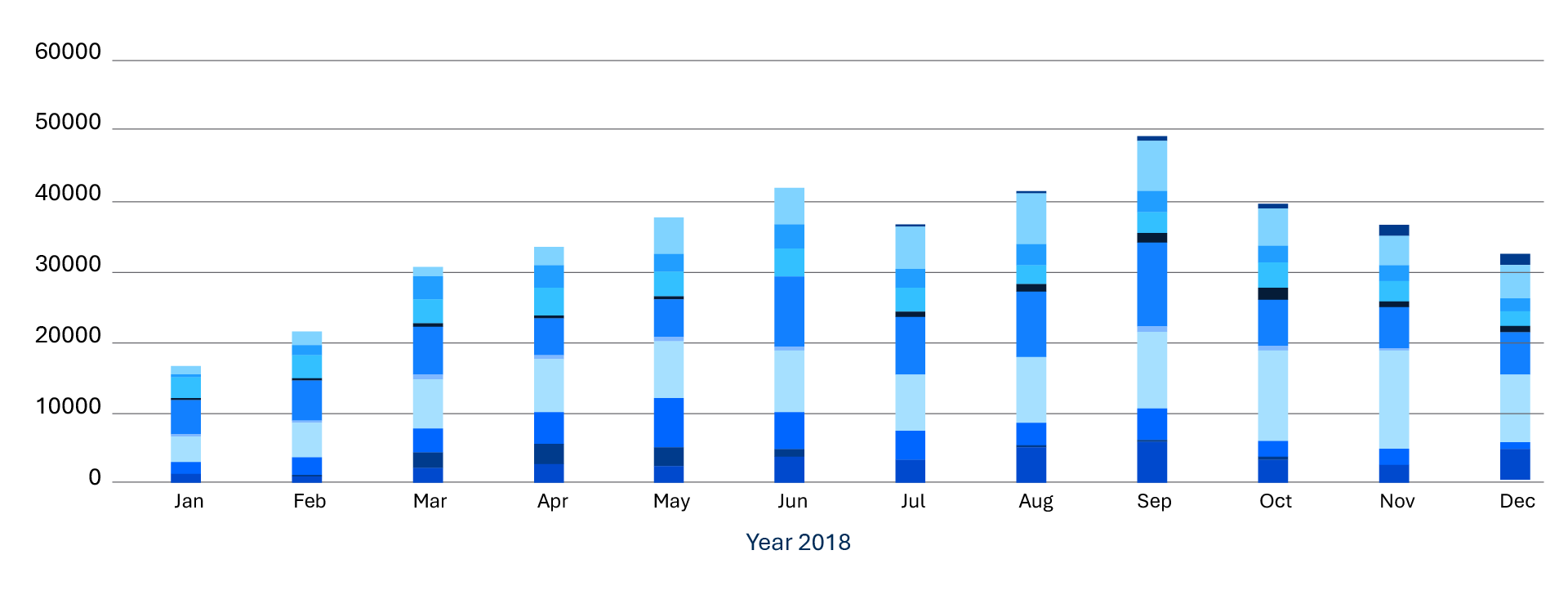

- Evaluating construction and engineering resources at the portfolio level. Resources are often shared across many projects, making it critical to evaluate, for example, a construction contractor at the portfolio level. The resource stack chart in Figure 4 evaluates each contractor’s capacity by spend, main installation, and service replacement to determine which contractors have the capacity to take on additional work and which are overallocated.

- Accounting realistically for high-level productivity and spend capacity. With a higher-level view, and without adjusting dozens of individual forecasts, the top-down forecasting view tempers overly optimistic contractor forecasts to accommodate everyday delays, inspection issues and equipment breakdowns.

An iterative estimating process improves the accuracy of cash flow forecasts throughout the life cycle of a project. As you move from the early planning stages of a project and get closer to construction, your estimate becomes increasingly accurate.

For example, when an MRP is being developed, perhaps still in the early planning stage, it might be reasonable to estimate that a project will require roughly 6,000 feet of an 8- or 6-inch plastic main with about 100 to 110 services, half of which are anticipated to be transfers and half to be inserts. Based on historical unit costs, this is enough information for a planning-level estimate.

As a project moves through planning and design, and a firm understanding of scope becomes apparent, estimates can be refined with specific unit quantities, still using historical unit costs. Finally, once a contractor has been selected, estimates can be further refined with actual unit costs — or lump sum — and an updated schedule for production. While these project controls techniques can be applied to projects large or small, increased effectiveness has been found to be associated with bundling main replacement work into neighborhood projects of at least 1 mile. Conducting work in a bundle, rather than in multiple small projects of several hundred feet each, has several benefits:

- Work can be efficiently handled as a distinct project, with a project manager and its own schedule.

- Work is simplified for the contractor — less mobilization cost, less time lost scheduling service replacements and potentially fewer tie-in pits.

- Pressure upgrades are more feasible in some neighborhoods.