Feature | September 30, 2025

From Bottleneck to Breakthrough: How 765-kV Transmission Could Save the Grid

Dramatic load growth and accelerating electrification are straining electrical networks across the country. Powerful 765-kV lines and substations could provide much-needed grid capacity and enhance reliability if they can overcome a variety of hurdles.

Like its midsummer heat, the Permian Basin’s pace of infrastructure change is merciless. With oil rigs humming, much of the machinery that once ran on diesel is being switched to electric motors.

For David Hancock, an engineering director at Burns & McDonnell, this transition is more than an industrial shift — it’s a race against time.

“They’ve been needing to get more power to the Permian Basin for much longer than they should have had to wait,” Hancock says. “The question was, how do you move that much power, that fast, over that distance?”

The answer Texas grid operators landed on in April 2025 is taller than a 10-story building and capable of carrying power hundreds of miles: 765-kilovolt (kV) transmission lines. While the U.S. has only a sprinkling of them today, these extra-high-voltage lines could become the backbone of a more resilient, higher-capacity grid.

Transmission is the quiet machinery of modern life, invisible until it falters. The U.S. electric grid has grown over decades like a poorly stitched patchwork quilt, region by region, utility by utility. The result: congestion and limited capacity to move power where it’s needed most, making it unfit for the demands of today and tomorrow.

The patchwork grid now strains under what James Amato, a vice president at Burns & McDonnell, calls a six-layer cake of needs: reliability, resiliency, electrification, renewable integration, data center demand and national security, all of which must be addressed while keeping cost prudency in mind.

“It’s the spine that connects everything else,” Amato says. “Right now, that spine is weak.”

From wind and solar farms stuck in interconnection queues to data centers and other large load centers hungry for gigawatts, demand is throttling the network. The electrification of everything — from transportation fleets to industrial processes and heating systems — is leaving users trying to gulp power through a straw.

Additional transmission capacity is essential. Building new lines is almost unavoidable. But that process can be painfully slow, as operators move to replace transmission lines constructed 50 or more years ago that are near or past the end of their anticipated life span. Knowing the speed with which demand is growing is encouraging utilities to develop large-scale, capital-intensive solutions.

Transmission planning and permitting alone can take up to seven years, according to D.H. Kim, a senior managing director at 1898 & Co. Combine the longest lead time of any major energy-sector infrastructure with several states’ abilities to block, challenge and delay interstate projects, and it’s easy to see how permitting poses a persistent obstacle. Fragmented governance of the grid makes it all too easy for projects to stall.

This is where the astonishing capacity of 765-kV transmission steps forward.

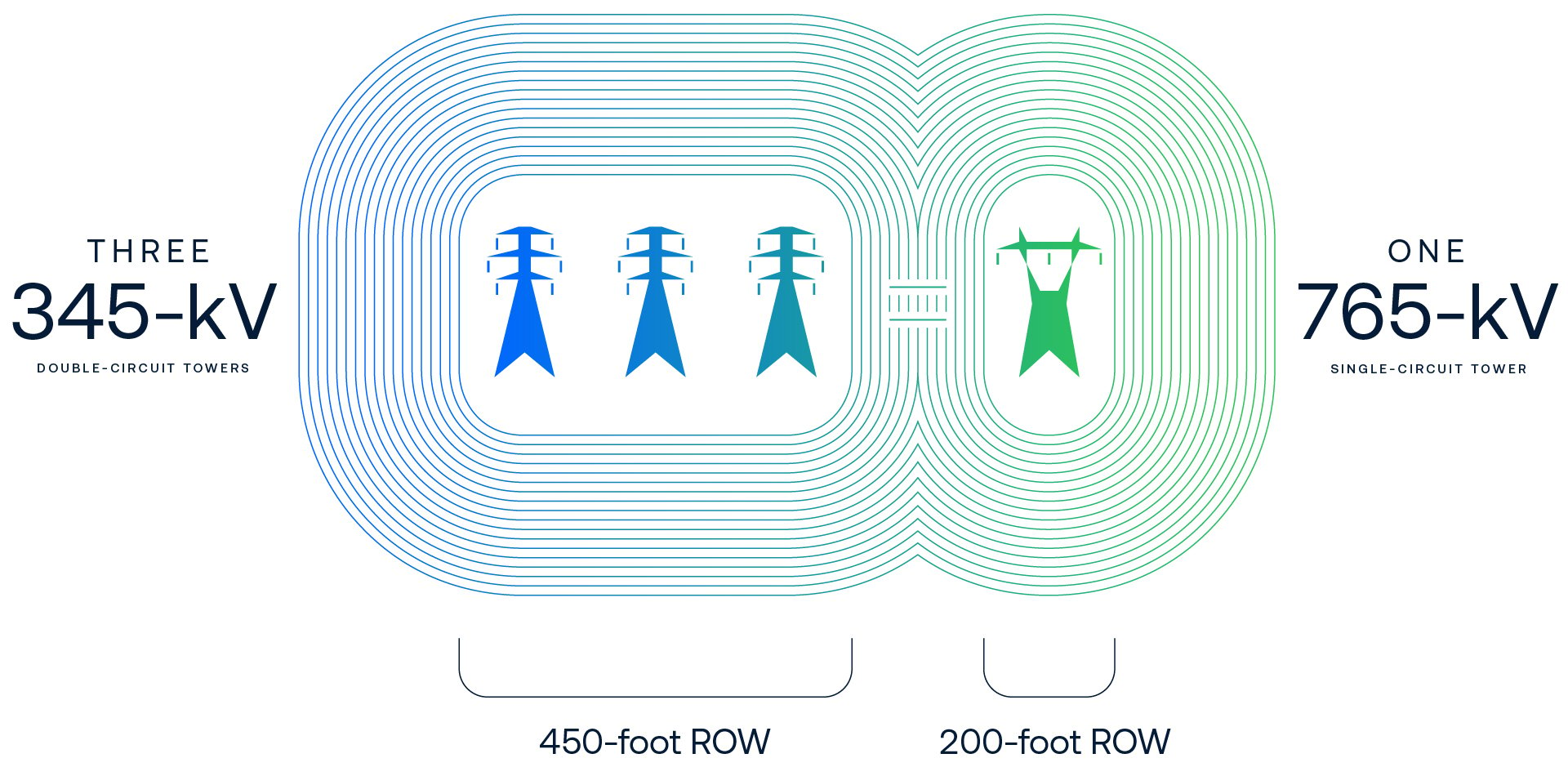

A single circuit of 765-kV can move as much electricity as three double-circuit or six single-circuit 345-kV lines while occupying a smaller overall right-of-way. It can carry three times the power of a 500-kV line.

This was a critical factor when the Public Utility Commission of Texas weighed the technology against 345-kV for the Permian Basin challenge. Although the commission found 765-kV to be the more expensive option, it would offer far more capacity and stability. Put another way, value trumped cost. Of greater importance was whether 765-kV could be deployed by the same deadlines previously sought for 345-kV lines; Texas regulators determined it was possible.

“Those advantages outweighed the difference in price,” Hancock says. “It wasn’t that 765-kV was the cheapest option, it was just the overall best option.”

The higher-voltage technology also offers efficiencies like lower line losses and fewer intermediate substations needed as it forms a spine to enable large-scale power sharing.

The concept of a broad 765-kV transmission network is not new. Amato recalls that close to two decades ago, there was an investor-owned utility movement for a national 765-kV grid, inspired by President Eisenhower’s vision for coast-to-coast interstate highway network. But self-interest, failed partnerships and a lack of political will and capital at the time doomed the plan.

“What was being offered was ahead of its time,” Amato says. “The need wasn’t realized at that time.”

Now the pressures that once felt distant are unavoidable: soaring demand, aging assets and renewable integration. The scale of need is greater and more visible, with demand for drivers coming into alignment.

Policy changes such as Federal Energy Regulatory Commission (FERC) Order 1000 have spurred competitive transmission development, and independent system operators (ISOs) and regional transmission organizations (RTOs) are factoring 765-kV transmission into long-term plans. Although U.S. experience with the technology has been limited to date, there is substantial proof of concept: 765-kV equipment has been successfully deployed in markets from South Africa to India and South Korea. Equipment manufacturing capacity exists globally, with lead times comparable to those for 345- and 500-kV equipment.

As 765-kV projects are moving from “what if” to “how fast,” developments are springing up in many regions:

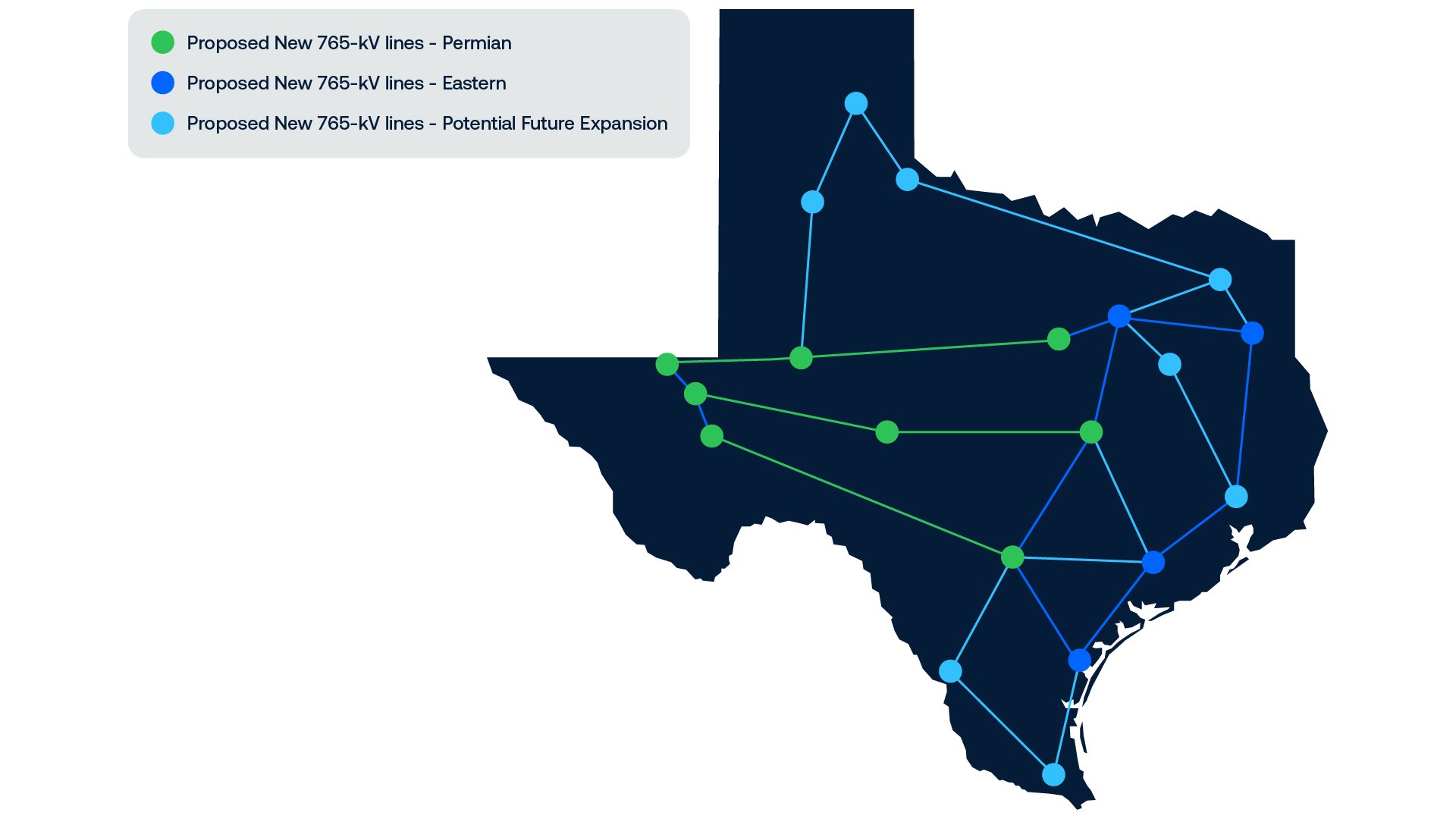

- Texas — Within the Electric Reliability Corp. of Texas (ERCOT), three 765-kV lines were approved in April. These lines and their associated upgrades have a total estimated cost of $10.1 billion, reflecting 1,255 miles of new lines expected to be placed into service by 2031. There are additional plans in development to extend the 765-kV network into other parts of the state in future phases.

- Midwest — As part of the Midwest ISO (MISO) Tranche 2.1, a power line and substation portfolio valued at $21.8 billion, a backbone of 765-kV transmission line and substation projects spanning its multistate footprint is set to be built. These projects have expected in-service dates in 2032-34.

- Mid-Atlantic — PJM Interconnection already features over 2,500 miles of 765-kV, the largest existing 765-kV network in the U.S. Because PJM territory is home to the largest concentration of data centers, and with the grid in northern Virginia experiencing substantial congestion, additional lines are planned to meet the rising demand. Specifically, 415 miles of new 765-kV transmission lines were approved earlier this year as a part of PJM’s 2024 Regional Transmission Expansion Plan (RTEP) Window 1.

- Central — The Southwestern Power Pool (SPP) Integrated Transmission Planning (ITP) 2024 portfolio includes a $1.7 billion, 293-mile greenfield 765-kV transmission line project. The 2025 portfolio is expected to include several billion dollars’ worth of 765-kV transmission line and substation projects in New Mexico, Texas, Oklahoma and Mississippi.

When utilities get guidance from ISOs and RTOs to pursue 765-kV initiatives, most do not yet have standards and specifications to guide their engineering and design efforts, Kim says.

“They need to thoroughly study those solutions,” says Kim, whose team works with utilities on transmission planning and power system analyses. “They don’t have that knowledge and experience in-house because they never had that asset class and never had to worry about it previously. Now they must examine the entire life cycle of the assets, starting from planning and moving into reliability studies, engineering, permitting and more.”

Despite the many drivers, obstacles to 765-kV transmission development remain daunting, perhaps most significantly involving permitting.

“Until a project’s permitted, it’s not real,” cautions Amato, drawing on more than two decades of experience in energy markets. “It’s like a mantra. That’s a real concern as utilities look at these massive efforts with permitting hurdles that are counterintuitive to our national security needs.”

Cost could be a notable obstacle, with some 765-kV transmission project estimates exceeding a billion dollars. Utilities, consultants and contractors are exceptionally cautious about risk. With so much on the line, organizations can be understandably nervous about the enterprise-level risk they could face.

Interstate coordination and approvals also can be a major hurdle, given states’ right to block portions of interstate lines. “That’s how things get shut down,” Amato says. “The states have the power, and if one doesn't see an incentive for their state, they can kill a necessary infrastructure project, and the ISOs and FERC won’t override it, unlike gas pipelines.”

(The Natural Gas Act of 1938 gives FERC authority to approve the siting of interstate pipelines and storage facilities. If FERC grants a certificate of public convenience and necessity, it gives developers the right of eminent domain to acquire land, overriding state or local opposition. However, federal authority for siting electric lines has historically been limited and indirect. Most siting and permitting authority was reserved for individual states, and interstate transmission lines often face resistance from states that perceive little local benefit. And although the 2005 Energy Policy Act gave FERC “backstop authority” to approve interstate electric transmission projects in federally designated National Interest Electric Transmission Corridors, this authority has rarely been used because of legal challenges and bureaucratic hurdles.)

Similarly, some states give utilities right of first refusal for competitive transmission projects. This can complicate interstate projects if one state allows a project to be bid but an adjacent state gives a different utility the right to intervene.

Political shifts can alter project trajectories as well. Changing administrations and priorities could accelerate or slow development.

Meanwhile, workforce retirements are draining the already-limited pool of builders experienced with 765-kV transmission. International partnerships could be a crucial method to leverage testing facilities, vendor networks and operational know-how.

Even amid challenges, the rising modern stakes seem to be high enough to defeat inertia and propel projects. Amato regards it as a race not just for electricity, but for strategic advantage.

“Whoever leads in power is going to lead in superintelligence and AI,” he says. “It's about having an intuitive 21st-century grid with high-voltage transmission and low-voltage distribution systems that are going to be intelligent enough to be able to withstand cyberattacks and strong enough to support technological dominance on a global scale.”

In that vision, 765-kV transmission is more than an engineering feat; it’s a pillar of national security. It is critical to maintaining energy, technology and military supremacy.

No one expects a quick build-out. Even in Texas, the timelines for the three new lines extend into the early 2030s. But if 765-kV lines are built as planned, they could set the stage for a broader network, forming a high-capacity backbone linking regions, enabling renewable power and giving the aging grid new vigor.

“The fact of the matter is, we need to increase our generation expansion right now and get the power where it needs to go,” Amato says. “We just need to get out of our own way. If we are all serious about the stakes right now and what manifestly needs to be done, everyone needs to be upfront and honest about the cost. This is going to cost an incredible amount of capital, and the cost of electricity is going to increase, but the alternative of status quo behavior is not an option.”

With coordinated strategic planning, timely permitting and effective collaboration, such high-voltage lines could turn a grid struggling to deliver clean energy, economic growth and reliability into a resilient, secure network capable of efficiently meeting the nation’s pressing energy demands.

Thought Leaders

James Amato

Vice President

Burns & McDonnell

David Hancock, PE

Engineering Director

Burns & McDonnell

Dong-Hyeon Kim

Senior Managing Director

1898 & Co.

Related Content

Article

Designing Transmission Lines With Construction Safety in Mind

Blog

5 Ways Utilities Are Balancing Investment, Load Growth and Customer Priorities

Blog

Powering the Grid: Embracing EPC for Extra-High-Voltage Growth

.png)