Feature | January 15, 2025

Hyperscale Data Centers and How to Power Them

The artificial intelligence revolution is poised to reshape both the data and power industries for decades to come. Building the data centers to fuel this advanced technology and supplying them with sufficient power are among today’s biggest challenges.

The rapid advancement of artificial intelligence (AI) technologies has ushered in a new era of computing, bringing with it unprecedented demands on our digital infrastructure and energy resources. The escalating adoption of AI applications — from machine learning to large language models (LLMs) — has intensified the demand for substantial, large-scale computational resources.

Data centers are essential building blocks in the infrastructure supporting AI-driven applications. Meeting the needs of the AI revolution will hinge on not only building more data centers but also finding sustainable ways to power them. The relationships among data centers, AI-powered industries and the energy market — along with the role of technology and potential regulations — are at the heart of shaping this dynamic landscape.

What does the future hold for data centers? Answering that question requires a deeper understanding of the power sources that will fuel their growth.

The AI Boom and Its Impact on Data Centers

With AI technology accelerating at an unprecedented pace, the market for data centers is undergoing an exponential shift. Hyperscalers — companies that operate massive data center infrastructure to support AI and cloud services — are at the forefront of this transformation.

AI workloads generally require higher power densities than traditional cloud computing. However, the industry is rapidly adapting to these new demands. While purpose-built AI infrastructure is still in its early stages, many existing data centers are being upgraded to accommodate AI workloads.

How Much Energy Do Data Centers Require?

The power consumption demands of AI-focused data centers are enormous, and the amount of available energy varies greatly, depending on location.

Data centers have undergone a remarkable transformation in power consumption over the past 15 years, says Christine Wood, a vice president at Burns & McDonnell and leader of the mission-critical market sector. In the past, a 12-megawatt (MW) data center was considered substantial. Today, hyperscale data center campuses commonly range from 60 MW to several hundred megawatts. However, the rise of AI has accelerated this trend, pushing power requirements even higher.

For contrast, the city of Dallas, Texas, has peak demand of 3 gigawatts (GW) to 5 GW for the entire city. And the Dallas area is among the largest growth markets in the U.S. for data centers.

These data centers are a big challenge in both power generation and electric infrastructure. The shift to AI-specific facilities spotlights the need for scalability and sustainable design.

U.S. data center electricity demand is expected to reach 35 GW in the next five years, according to Utility Dive. As demand grows, teams are under increasing pressure to design for higher power densitties while keeping consumption efficient and sustainable.

This begs an obvious question: Can the energy sector keep pace with the growing needs of AI? Wood says the answer is yes, but it’s complicated.

While requests are rapidly escalating to assess power availability for new data center sites, their development presents unique challenges. The costs involved are substantial, requiring not only significant capital investment but also specialized experience in areas like on-site substation construction and strategic power agreements.

Power generation and storage solutions will be key to sustaining the growth of AI data centers. Recent integrated resource plans (IRPs) indicate that utilities are planning for the largest increase in gas plants in over a decade to address immediate needs, with dramatic increases in renewable energy usage expected over the course of the next 5 years to balance and maintain grid reliability.

Chris Ruckman, a vice president at Burns & McDonnell focused on energy storage, emphasizes the role of storage systems in managing fluctuating demand.

“Energy storage systems are becoming critical for managing peak loads and maintaining resilience,” Ruckman says. “Data centers will increasingly rely on these systems to avoid overburdening the grid.”

Regional Energy Challenges

Some regions of the U.S. are feeling the strain of AI data centers more acutely than others. Power availability is a major concern for the industry, particularly in high-demand areas like Northern Virginia near Washington, D.C.

“With its concentration of hyperscale data centers, Northern Virginia is pushing the limits of power capacity,” Ruckman says. “Over 70% of global internet traffic already flows through the region, and the power demand for data centers in the area has increased by about 500% over the last decade.”

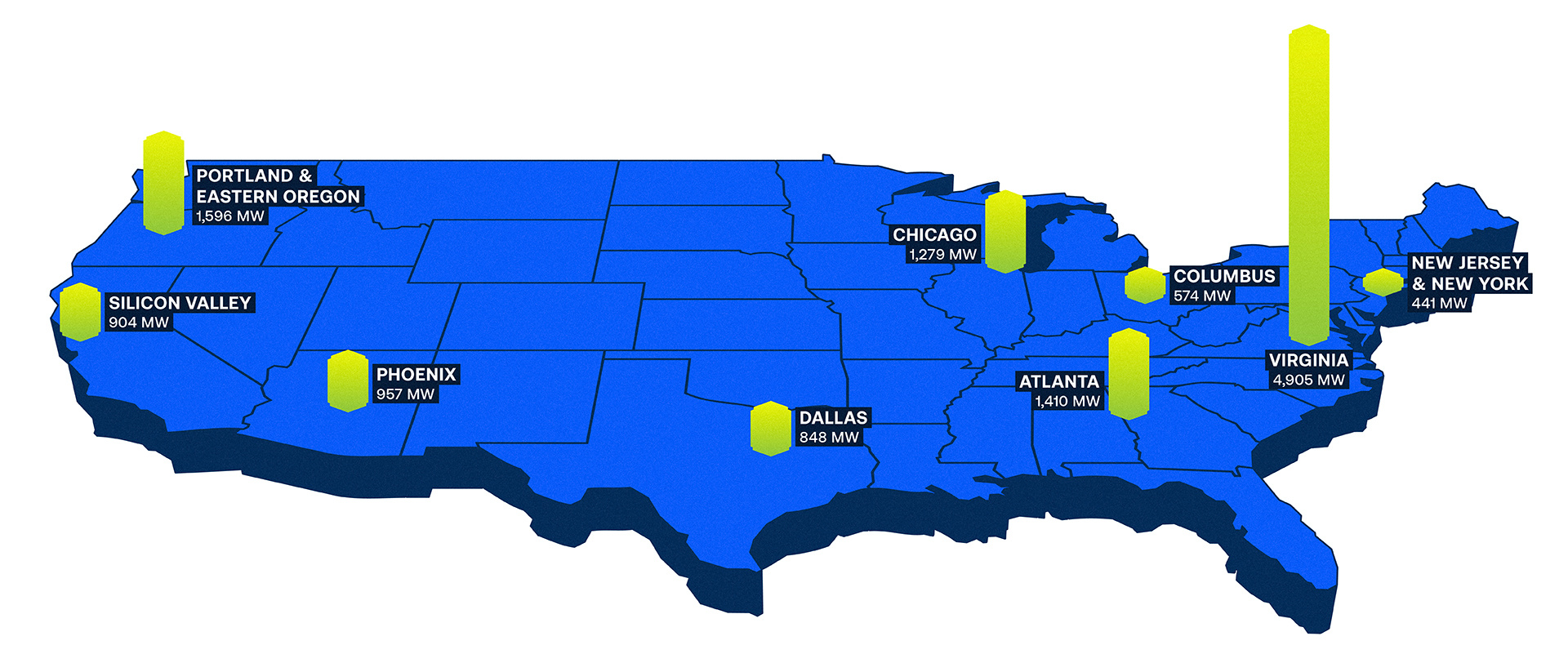

The data center capacity in Northern Virginia alone surpasses every other individual country outside the U.S. except China. Other major data center markets in the U.S. include Dallas, Texas; Phoenix, Arizona; Columbus, Ohio; and several cities across the Midwest.

Figure 1: Top U.S. markets by operational IT load in 2024. Source: Cushman & Wakefield.

Regions like the Dallas and Phoenix metropolitan areas are also important players, but they similarly face challenges related to power availability and electrical infrastructure. Both markets are expected to add over 3 GW of data center capacity over the next five years, according to S&P Global.

“We’re seeing more interest in developing data centers in these regions, but the same constraints on power sourcing and transmission apply,” Ruckman says. “It’s essential that developers carefully assess power availability before breaking ground on new sites.”

Getting Onto the Grid

With power demand expected to continue escalating rapidly, developers and energy providers are working together to identify regions with sufficient grid capacity. Keegan Odle, a vice president at

Burns & McDonnell, notes that power production is dependent upon location, with different regional transmission operators (RTOs) helping see that the generation mix appropriately matches the load.

“The RTOs have to balance the changing generation mix and local, state and federal legislation that affects the type of power generation that can be used,” Odle says. “Grid stability and reliability are paramount. It’s a delicate balance among meeting end-user needs, complying with regulations, managing costs and maintaining reliability.”

Transmission systems will need to evolve to handle the increased load from AI data centers. The expansion of AI is placing a significant burden on existing infrastructure, making it critical to upgrade the grid and provide robust interconnections.

The grid’s capacity is limited to what the existing transmission lines can deliver, Odle says. Options to increase capacity — rebuilding the line or adding conductors — are costly and take a lot of time.

“The best things developers can do are to be accurate with the load ramp schedule for a facility and to quickly execute the service agreement with the local power provider,” he says. “You can also improve the chance for success by building as close to an existing transmission line as possible to limit the amount of permitting required to connect your facility to the grid.”

While careful site selection and thorough planning will improve the odds of interconnecting successfully, it is important to be realistic.

“The power market is currently experiencing multiple once-in-a-lifetime events concurrently,” Odle says. “There is the push for renewable energy generation, new regulations, the electrification of transportation and heavy industrial, and significant attrition among construction workers. Patience and preparation are essential.”

Exploring Additional Energy Solutions

With data centers operating 24/7, the need for reliable, constant energy supply is extremely important. This makes certain energy solutions, like nuclear, an attractive option. Renewables have made an impact, but the operational needs of data centers require an option that can provide consistent output.

This can become a mutually beneficial arrangement. Nuclear power is slow to ramp up, but data centers provide a consistent, ongoing demand for such power. In turn, the nuclear plants deliver a reliable, large-scale power supply.

Nuclear small modular reactors (SMRs) and long-duration energy storage could also be promising elements for dedicated on-site power sources.

While You’re Waiting: Rapid Deployment Microgrids

While nuclear power certainly has a role to play, SMRs are not expected to be a viable source for another six to eight years. The difficulty for local utilities to provide the power required by data centers in a timely manner has led to the genesis of rapid deployment microgrid projects, says Tom Parker, director of on-site energy and power at Burns & McDonnell.

“These projects combine smaller, commercially available generation assets — such as reciprocating internal combustion engines and/or industrial combustion turbine generators — operated in parallel but in an islanded configuration, with no connection to the utility grid,” Parker says. “Essentially, the data center has its own power station.”

A rapid deployment microgrid provides power to a data center in advance of electrical utility capacity being available to service the facility. It can be used for alternate deployment once sufficient utility capacity is available and can be delivered to the site.

Ruckman says long-duration energy storage — especially combined with renewables like wind and solar — could be a game-changer: “Several energy storage technologies that offer 12+ hours of power are showing promise. The key will be scaling manufacturing and driving down capital costs.”

As industries continue to work through the energy transition, natural gas remains a crucial part of the energy mix. Natural gas generation is expected to continue to play a significant role in meeting data center demand, even as the data center industry pursues long-term carbon reduction goals.

“We simply can’t build enough renewables and energy storage fast enough to replace the power generated by natural gas,” Ruckman says. “That said, we are seeing increased interest in technologies that reduce the carbon footprint of gas plants, such as carbon sequestration.”

While natural gas remains necessary, Ruckman notes the industry is moving toward a more diversified energy portfolio.

“Renewables, gas, nuclear — all of these will see healthy growth,” he says. “As available power becomes scarcer in certain regions, solutions like combined-cycle gas power plants and renewables paired with battery storage will become increasingly viable.”

Building Efficiently, Running Sustainably

Relationships among AI, data centers and energy markets are expected to become even more intertwined in the coming years. Wood sees efficiency and sustainability as essential for future data center development.

“We’re already seeing a shift toward energy-efficient designs and advanced cooling systems to manage higher-density workloads,” she says.

Liquid cooling is a promising technology to support the implementation of high-density servers — the type and scale of configurations that hyperscalers need.

Costs and the complexities of retrofitting can make liquid cooling a challenging approach to apply, but the risks associated with inaction and waiting for existing technologies to phase out could prove more costly in the long run.

Wood also cites prefabrication and modular construction as valuable efficiency measures to bring new data centers to market quickly.

“A hybrid approach that combines some modular rooms and prefab steel is more typical than fully modular construction or prefabricated facilities,” she says.

The Convergence of Critical Industries

The intersection of data centers and power is becoming a nexus of discussion in the industry, and one that continues to grow in gravity as the use of AI explodes. This convergence may drive new opportunities for education and collaboration.

“As AI continues to drive demand for computing power, the partnerships between the power and data center industries will be crucial in developing sustainable, efficient and reliable solutions to support the digital infrastructure of the future,” Wood says.

The future of data centers and energy production is one of immense opportunity, but also significant challenges. As AI continues to drive demand for larger, denser data centers, the need for innovative energy solutions and sustainable designs will only grow.

“We’re at the start of something big,” Wood says. “The rapid growth of AI feels like the early days of the internet, but with even greater potential for impact as we design mature technological ecosystems.”

Thought Leaders

Keegan Odle

Vice President

Burns & McDonnell

Tom Parker

OnSite Energy & Power Director

Burns & McDonnell

Chris Ruckman

Vice President, Energy Storage

Burns & McDonnell

Christine Wood

Vice President, Mission Critical

Burns & McDonnell

Related Content

White Paper

Fluid Dynamics: Liquid Cooling’s Role in the Future of Data Centers

Blog

Meet Growing Data Center Power Demands With Reciprocating Engines

Article

Power Play: Accelerating Delivery of a Data Center Facility

.png)